Jill is interested in determining her asset allocation for her 401-K retirement plan. Her company has 10

Question:

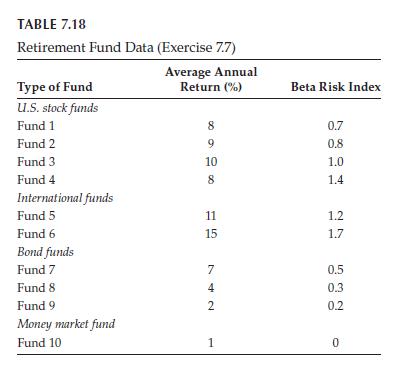

Jill is interested in determining her asset allocation for her 401-K retirement plan. Her company has 10 mutual funds for investment.

Their past performance data are given in Table 7.18.

Even though Jill is interested in the “growth” of her portfolio, she has the following investment restrictions:

i. No more than 20% should be invested in any one fund.

ii. 30%–45% should be invested in U.S. stock funds.

iii. 10%–25% should be invested in international funds iv. At least 15% should be invested in bond funds.

v. Total investment in U.S. and international stock funds should not exceed 70%.

vi. At least 5% should be invested in money market fund.

a. Formulate Jill’s asset allocation problem as Sharpe’s bi-criteria linear program.

b. Determine the ideal solution and the upper and lower bounds on the portfolio’s return and Beta risk

c. Determine the optimal portfolio that will give at least a 10%

average return under minimum Beta risk

Step by Step Answer:

Service Systems Engineering And Management

ISBN: 978-0367781323

1st Edition

Authors: A. Ravi Ravindran ,Paul M. Griffin ,Vittaldas V. Prabhu