A young investor is considering three potential stock mutual funds for investment. Based on the last 20

Question:

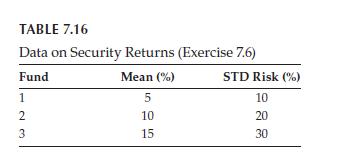

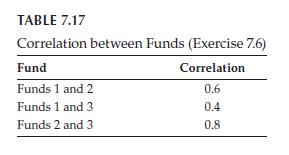

A young investor is considering three potential stock mutual funds for investment. Based on the last 20 years of performance data, the average returns and STD risks have been computed as shown in Table 7.16. The funds are also positively correlated as shown in Table 7.17.

The investor has $50,000 to invest and has the following investment restrictions:

i. No more than 50% should be invested in any one fund.

ii. Invest at least $10,000 in Fund 1.

iii. Invest at least $15,000 in Fund 2.

iv. Invest no more than 70% in Funds 2 and 3.

v. Invest all the $50,000 among the three funds.

The objective of the investor is to achieve maximum portfolio return and minimum portfolio variance.

a. Formulate the above problem as Markowitz’s bi-criteria optimization model.

b. Determine the minimum variance portfolio that will yield an average portfolio return of 12%.

Step by Step Answer:

Service Systems Engineering And Management

ISBN: 978-0367781323

1st Edition

Authors: A. Ravi Ravindran ,Paul M. Griffin ,Vittaldas V. Prabhu