The Tiller family has an adjusted gross income of $200,000 in 2020. The Tillers have two children,

Question:

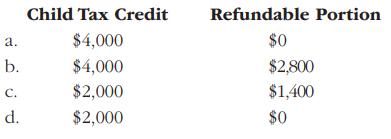

The Tiller family has an adjusted gross income of $200,000 in 2020. The Tillers have two children, ages 12 and 13, who qualify as dependents. All of the Tillers’ income is from wages. What is the Tillers’ child tax credit, and what portion of their child tax credit is refundable?

Transcribed Image Text:

a. b. C. d. Child Tax Credit $4,000 $4,000 $2,000 $2,000 Refundable Portion $0 $2,800 $1,400 $0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

Solution The Tiller children have a total of 500 in personal exemptions an...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

The Tiller family has an adjusted gross income of $200,000. The Tillers have two children, ages 12 and 13, who qualify as dependents. All of the Tillers income is from wages. What is the Tillers...

-

Tony and Jeannie Nelson are married and file a joint return. They have four children whose ages are: 12,15,19 & 23. The three youngest live at home with their parents and qualify as their...

-

1. Russ and Linda are married and file a joint tax return claiming their three children, ages 4, 7, and 18, as dependents. Their adjusted gross income for 2014 is $105,300. What is Russ and Lindas...

-

Suppose that, in an attempt to raise more revenue, Nowhere State University (NSU) increases its tuition. Will this necessarily result in more revenue? Under what conditions will revenue (a) rise, (b)...

-

Suppose that ln(S) and ln(Q) have correlation =0.3 and that S(0) = $100, Q(0) = $100, r = 0.06, S = 0.4, and Q = 0.2. Neither stock pays dividends. Use equation (20.38) to find the price today of...

-

Countrywide, once the largest mortgage company in the United States, was acquired by Bank of America in __________.

-

Thermal strain is expressed by. (a) \(\alpha . \Delta t\) (b) \(\alpha l . \Delta t\) (c) \(E \alpha . \Delta t\) (d) \(E . \Delta t\)

-

Based on the information provided in Table 8.19, calculate the estimated time to complete a textbook project. Rohan, an MBA fresh from the university, found an attractive position with a local...

-

Define and Explain Developmental Psychology with Headings . Also include diagrams and pictures related to Developmental Psychology.

-

The structure is subjected to the loadings shown. Member AB is supported by a ball-and-socket at A and smooth collar at B. Member CD is supported by a pin at C. Determine the x, y, z components of...

-

Casey is a U.S. citizen employed by a multinational corporation at its London office. Casey is married to Michael, a British citizen, and they reside in England. Michael receives substantial rent...

-

Mark and Lisa were divorced in 2020. In 2021, Mark has custody of their children, but Lisa provides nearly all of their support. Who is entitled to claim the children as dependents?

-

Given the element with stresses as shown in the figure: (a) Find the magnitude and direction of ÏH and ÏH. (b) Find the magnitude and direction of Ï1 and Ï3.? 4.0 3.0 2.0 75 8.0...

-

The following technical terms appear for the first time in this chapter. Check that you know the meaning of each. (If you cant find them again in the text, there is a glossary at the end of the...

-

Employees as assets of a service business The following extracts are taken from the annual reports of two companies that rely heavily on a skilled workforce. Although the workforce is not recognized...

-

Shareholders funds as at 21 March 2009 were 4,376 million (2008: 4,935 million), a reduction of 559 million, primarily as a result of the deterioration of the pension surplus into a deficit, which...

-

Cash flows Extracts from management reviews within annual reports Marks and Spencer plc We took a number of actions to improve our cash flow in 2008/09. In addition to reducing capital expenditure to...

-

This case extracts information from the annual report of Cadbury plc to show how the company explains its management of current assets. The cost of inventories recognized as an expense for the period...

-

The electrical power P drawn from a generator by a light bulb of resistance R is P = V2/R, where V is the line voltage. The resistance of bulb B is 42% greater than the resistance of bulb A. What is...

-

Nitrogen monoxide reacts with hydrogen as follows: 2NO(g)+ H2(g) N2O(g) + H2O(g) The rate law is [H2]/ t = k[NO]2[H2], where k is 1.10 107 L2/(mol2s) at 826oC. A vessel contains NO and H2 at...

-

Cite two examples of business products that require a substantial amount of service in order to be useful.

-

Explain why a new law office might want to lease furniture rather than buy it.

-

Would you expect to find any wholesalers selling the various types of business products? Are retail stores required (or something like retail stores)?

-

How does culture relate to political and security issues in the world? Please provide specific examples. 2 What are the most significant contemporary security issues in the world? How does culture...

-

Tree Seedlings has the following current-year purchases and sales for its only product. Units Acquired at Cost Date January 1 Activities Beginning inventory January 3 Sales February 14 February 15...

-

A resistor of an unknown resistance is placed in an insulated container filled with 0.50 kg of water. A voltage source is connected in series with the resistor and a current of 1.2 amps flows through...

Study smarter with the SolutionInn App