During 2022, Jos, a self-employed technology consultant, made gifts in the following amounts: In addition, on professional

Question:

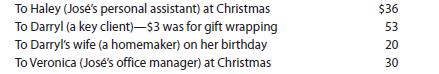

During 2022, José, a self-employed technology consultant, made gifts in the following amounts:

In addition, on professional assistants’ day, José takes Haley to lunch at a local restaurant at a cost of $82. Presuming that José has adequate substantiation, how much can he deduct?

Transcribed Image Text:

To Haley (José's personal assistant) at Christmas To Darryl (a key client)-$3 was for gift wrapping To Darryl's wife (a homemaker) on her birthday To Veronica (José's office manager) at Christmas $36 53 20 30

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

160 25 28 25 82 No deduction is allowed for Darryls wife since the maximum gift a...View the full answer

Answered By

John Kago

Am a processional practicing accountant with 5 years experience in practice, I also happens to have hands on experience in economic analysis and statistical research for 3 years. am well conversant with Accounting packages, sage, pastel, quick books, hansa world, etc, I have real work experience with Strata, and SPSS

4.70+

31+ Reviews

77+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

1. In the fictional land of Westeros, House Lannister vies with rival Houses for control of the throne. War breaks out. To finance its war operations, House Lannister borrows 900,000 gold pieces from...

-

During 2021, Jos, a self-employed technology consultant, made gifts in the following amounts. In addition, on professional assistants day, Jos takes Haley to lunch at a local restaurant at a cost of...

-

During 2022, Jos, a self-employed technology consultant, made gifts in the following amounts. In addition, on professional assistants day, Jos takes Haley to lunch at a local restaurant at a cost of...

-

Steam leaves a nozzle with a pressure of 500 kPa, a temperature of 350C, and a velocity of 250 m/s. What is the isentropic stagnation pressure and temperature?

-

Why are incidental costs sometimes ignored in inventory costing? Under what accounting constraint is this permitted?

-

Can organisational culture be changed at will?

-

23. Suppose that u < e(r)h. Show that there is an arbitrage opportunity. Now suppose that d >e(r)h. Show again that there is an arbitrage opportunity.

-

Tonys Precision Computer Centre is picking up in business, so he has decided to expand his bookkeeping system to a general journal/ledger system. The balances from June have been forwarded to the...

-

[The following information applies to the questions displayed below.] Elegant Decor Company's management is trying to decide whether to eliminate Department 200, which has produced losses or low...

-

Salamander Inc. is a food processing company that operates divisions in three major lines of food products: cereals, frozen fish, and candy. On 13 September 20X1, the Board of Directors voted to put...

-

Robin inherits 1,000 shares of Walmart stock from her aunt Julieta in 2022. According to the information received from the executor of Julietas estate, Robins adjusted basis for the stock is $55,000....

-

During 2022, Stork Associates paid $60,000 for a 20-seat skybox at Veterans Stadium for eight professional football games. Regular seats to these games range from $80 to $250 each. At one game, an...

-

Use implicit differentiation to find an equation of the tangent line to the curve at the given point. 25. x + xy + y = 3. (1, 1) (ellipse) %3D 26. x + 2xy y + x = 2. (1,2) (hyperbola) 28. x + y/3 =...

-

Use the Comprehensive Annual Financial Report for the Village of Arlington Heights (please look up this content) for the year ended December 31, 2018, to answer questions 8-20. All questions are on...

-

The pulse rates of 152 randomly selected adult males vary from a low of 37 bpm to a high of 117 bpm. Find the minimum sample size required to estimate the mean pulse rate of adult males. Assume that...

-

Two wires lie perpendicular to the plane of the screen and carry equal magnitudes of electric current in the directions shown. Point P is equidistant from the two wires. The distance between each of...

-

Your firm has recently been appointed as auditors of Kentronics Ltd , a large company which markets sophisticated electronic equipment for heavy industry as well as the mining equipment industry. The...

-

The pulse rates of 152 randomly selected adult males vary from a low of 37 bpm to a high of 117 bpm. Find the minimum sample size required to estimate the mean pulse rate of adult males. Assume that...

-

What are foreign trade zones? How are they different from free trade zones? What benefits do they provide?

-

Refer to the data in QS 10-1. Based on financial considerations alone, should Helix accept this order at the special price? Explain.

-

A corporation distributes a truck it has owned for three years to its sole shareholder. The shareholder will use the truck for personal use activity. The truck's fair market value at the time of the...

-

A corporation distributes a truck it has owned for three years to its sole shareholder. The shareholder will use the truck for personal use activity. The truck's fair market value at the time of the...

-

A corporation distributes a truck it has owned for three years to its sole shareholder. The shareholder will use the truck for personal use activity. The truck's fair market value at the time of the...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App