Elliott has the following capital gain and loss transactions for 2022. After the capital gain and loss

Question:

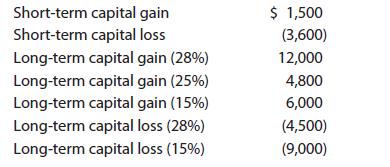

Elliott has the following capital gain and loss transactions for 2022.

After the capital gain and loss netting process, what is the amount and character of Elliott’s gain or loss?

Transcribed Image Text:

Short-term capital gain Short-term capital loss Long-term capital gain (28%) Long-term capital gain (25%) Long-term capital gain (15%) Long-term capital loss (28%) Long-term capital loss (15%) $ 1,500 (3,600) 12,000 4,800 6,000 (4,500) (9,000)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Elliott first nets the shortterm gains and losses ...View the full answer

Answered By

Susan Juma

I'm available and reachable 24/7. I have high experience in helping students with their assignments, proposals, and dissertations. Most importantly, I'm a professional accountant and I can handle all kinds of accounting and finance problems.

4.40+

15+ Reviews

45+ Question Solved

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Elliott has the following capital gain and loss transactions for 2017. After the capital gain and loss netting process, what is the amount and character of Elliotts gain or loss? $ 1,500 Short-term...

-

Elliott has the following capital gain and loss transactions for 2015. Short-term capital gain .......................................... $ 1,500 Short-term capital loss...

-

Elliott has the following capital gain and loss transactions for 2016. Short-term capital gain .................................. $ 1,500 Short-term capital loss ......................................

-

Evaluate and simplify the following derivatives. d dw -(e-w In w)

-

List the components of a DBMS and describe the function of each.

-

The following paired sample data have been obtained from normally distributed populations. Construct a 90% confidence interval estimate for the mean paired difference between the two population...

-

(a) Find the solution to the following PDE: \[\begin{aligned}& \frac{\partial^{2} u}{\partial t^{2}}=\frac{\partial^{2} u}{\partial x^{2}} \\& u(0, t)=u(L, t)=0 \\& u(x, 0)=0 \\& \frac{\partial...

-

Sarah and Gabe are considering the following transactions and have asked you to explain the impact of the transactions on their Statement of Financial Position: Purchase a baseball card collection...

-

On January 13, 2023, Jason, a cash basis taxpayer, was one of 3 winners of a $1.6 billion Powerball jackpot. Jason had the option to receive a one-time cash payment of $327.8 million or 30 annual...

-

Shen purchased corporate stock for $20,000 on April 10, 2020. On July 14, 2022, when the stock was worth $12,000, Shen died and his son, Mijo, inherited the stock. Mijo sold the stock for $14,200 on...

-

George is the owner of numerous classic automobiles. His intention is to hold the automobiles until they increase in value and then sell them. He rents the automobiles for use in various events...

-

Assume the same facts as in the previous problem, except that the business expects to make a cash distribution of $28,000 each to June and John the first year. Determine how much tax the business...

-

Under what conditions is the Durbin-Watson test unreliable in its search for autocorrelation?

-

To record depreciation relating to the new machines purchased by Shady Oaks Centre, management has estimated residual values and the expected life. Required Discuss the procedures that may be...

-

In 1975, interest rates were 7.98% and the rate of inflation was 12.6% in the United States. What was the real interest rate in 1975? How would the purchasing power of your savings have changed over...

-

When depreciation follows income of an estate or complex trust, explain the situation where wastage could occur.

-

If the rate of inflation is 4.2%, what nominal interest rate is necessary for you to earn a 2.8% real interest rate on your investment?

-

Using your estimate for the degree of operating leverage for Global in 2015, estimate the level of operating income if the following years sales a) rise by 5 percent; b) fall by 12 percent.

-

How can you tell from the vertex form y = a(x - h) 2 + k whether a quadratic function has no real zeros?

-

Compute the undervaluation penalty for each of the following independent cases involving the value of a closely held business in the decedent's gross estate. In each case, assume a marginal estate...

-

Compute the undervaluation penalty for each of the following independent cases involving the value of a closely held business in the decedent's gross estate. In each case, assume a marginal estate...

-

Singh, a qualified appraiser of fine art and other collectibles, was advising Colleen when she was determining the amount of the charitable contribution deduction for a gift of sculpture to a museum....

-

In the "big history" view, if we were to put all of past time since the beginning of the universe on a 12-month calendar, then recorded human history would begin in the last second of the evening on...

-

Let Y be a continuous random variable with probability density function: f(y) = ky k(2 y) 0 y 1 1 y 2 0 otherwise a. Find the value for k so that f(y) is a probability density function (5 points) b....

-

Company A provides you with the following information for its unique products X and Y. In total A has sold 8,000 units. X Y Turnover 140000$ 400000$ Costs of goods sold 108 000 258 000 Gross margin...

Study smarter with the SolutionInn App