Trevor, a friend of yours from high school, works as a server at the ST Caf. He

Question:

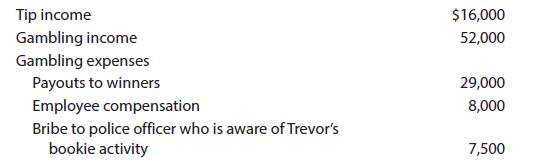

Trevor, a friend of yours from high school, works as a server at the ST Café. He asks you to help him prepare his Federal income tax return. When you inquire about why his bank deposits substantially exceed his tip income, he confides to you that he is a bookie on the side. Trevor then provides you with the following documented income and expenses for the year:

a. How will these items affect Trevor’s AGI (ignore the impact of self-employment taxes)?

b. His taxable income (ignore the impact of self-employment taxes)?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2023 Comprehensive Volume

ISBN: 9780357719688

46th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted: