At the time of his death this year on September 4, Kenneth owned the following assets, among

Question:

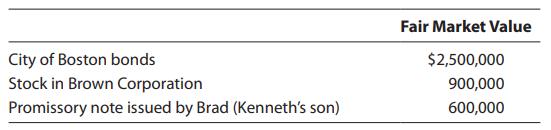

At the time of his death this year on September 4, Kenneth owned the following assets, among others:

In October, the executor of Kenneth’s estate received the following: $120,000 interest on the City of Boston bonds ($10,000 accrued since September 4) and a $7,000 cash dividend on the Brown stock (date of record was September 5). The declaration date on the dividend was August 12.

In October, the executor of Kenneth’s estate received the following: $120,000 interest on the City of Boston bonds ($10,000 accrued since September 4) and a $7,000 cash dividend on the Brown stock (date of record was September 5). The declaration date on the dividend was August 12.

The $600,000 loan was made to Brad in late 2015, and he used the money to create a very successful business. The note was forgiven by Kenneth in his will. What are the estate tax consequences of these transactions?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2020 Comprehensive

ISBN: 9780357109144

43rd Edition

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

Question Posted: