The Home Depot, Inc. (HD) operates over 2,200 home improvement retail stores and is a competitor of

Question:

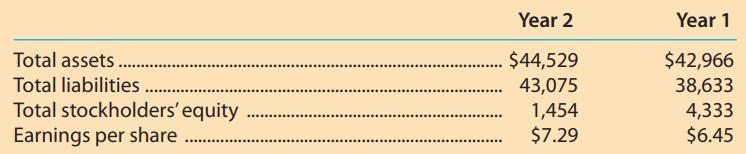

The Home Depot, Inc. (HD) operates over 2,200 home improvement retail stores and is a competitor of Lowe’s (LOW). The following data (in millions) were adapted from recent financial statements of The Home Depot.

1. Compute the debt ratio for Years 1 and 2. Round to one decimal place.

2. Given your answer to part (1), what is the ratio of stockholders’ equity to total assets for Years 1 and 2? Round to one decimal place.

3. Are Home Depot’s operations financed primarily with liabilities or equity?

4. Comparing Years 1 and 2, should creditors feel more or less safe in Year 2?

5. With a market price of $187.41, compute the price-earnings ratio for Year 2.

6. With a market price of $129.59, compute the price-earnings ratio for Year 1.

7. Compare the results from parts (5) and (6). Comment on any differences.

Step by Step Answer: