When Godfrey died in 2019, his assets were valued as follows: The executor sold the stock two

Question:

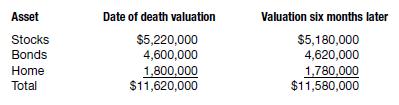

When Godfrey died in 2019, his assets were valued as follows:

The executor sold the stock two months after the decedent’s death for $5,200,000. The bonds were sold seven months after the decedent’s death for $4,630,000. What valuation should be used for the gross estate?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Taxation For Decision Makers 2020

ISBN: 9781119562108

10th Edition

Authors: Shirley Dennis Escoffier, Karen Fortin

Question Posted: