Markells basis in the Markit Partnership is $58,000. In a proportionate liquidating distribution, Markell receives the following

Question:

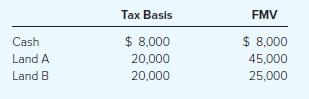

Markell’s basis in the Markit Partnership is $58,000. In a proportionate liquidating distribution, Markell receives the following assets:

a) How much gain or loss will Markell recognize on the distribution? What is the character of any recognized gain or loss?

b) What is Markell’s basis in the distributed assets?

Transcribed Image Text:

Cash Land A Land B Tax Basis $8,000 20,000 20,000 FMV $8,000 45,000 25,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (6 reviews)

a Markell does not recognize any gain or loss on the distribution b Since Markits basis of the distr...View the full answer

Answered By

Lamya S

Highly creative, resourceful and dedicated High School Teacher with a good fluency in English (IELTS- 7.5 band scorer) and an excellent record of successful classroom presentations.

I have more than 2 years experience in tutoring students especially by using my note making strategies.

Especially adept at teaching methods of business functions and management through a positive, and flexible teaching style with the willingness to work beyond the call of duty.

Committed to ongoing professional development and spreading the knowledge within myself to the blooming ones to make them fly with a colorful wing of future.

I do always believe that more than being a teacher who teaches students subjects,...i rather want to be a teacher who wants to teach students how to love learning..

Subjects i handle :

Business studies

Management studies

Operations Management

Organisational Behaviour

Change Management

Research Methodology

Strategy Management

Economics

Human Resource Management

Performance Management

Training

International Business

Business Ethics

Business Communication

Things you can expect from me :

- A clear cut answer

- A detailed conceptual way of explanation

- Simplified answer form of complex topics

- Diagrams and examples filled answers

4.90+

46+ Reviews

54+ Question Solved

Related Book For

Taxation Of Individuals And Business Entities 2023 Edition

ISBN: 9781265790295

14th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham

Question Posted:

Students also viewed these Business questions

-

Bryce's basis in the Markit Partnership is $58,000. In a proportionate liquidating distribution, Bryce receives the following assets: .................................Tax Basis..............FMV...

-

Capital Partnership makes a proportionate liquidating distribution to one of its partners of $5,000 cash, $6,000 inventory (FMV = $10,000), and land with a $20,000 basis and an $11,000 fair market...

-

In a proportionate liquidating distribution in which the partnership also liquidates, ABC LLP distributes cash, inventory, and unrealized receivables. How does partner Angie determine her basis in...

-

Furniture Co. incurred the following costs during 2016: Conversion costs Prime costs Manufacturing overhead What was the amount of direct materials and direct labor used for the year? Direct...

-

Consider the time-varying process behavior shown below and on the next page. Match each of these several patterns of process performance to the corresponding and R charts shown in figures (a) to (e)...

-

Let X be a continuous random variable with cdf F(x). Suppose Y = X+, where > 0. Show that Y is stochastically larger than X.

-

What are the different types of schemes associated with complex frauds?

-

Thom DeBusk, an architect, is considering buying, restoring, and reselling a home in the Draper-Preston historic district of Blacksburg, VA. The cost of the home is $240,000 and Thom believes it can...

-

Write a program the reads from the user a real number. Then your program displays 2 choices to the user. 1- get the square of input 2- get square root of input Based on the user's choice, the program...

-

1.4. Dupont's Kevlar is a high-strength, high-modulus fiber. The chemical repeat is shown as below (Allen Q2. 11.) Bond lengths c-C =1.54 H c=C=1.33 N-C=1.47 (a) Assuming Kevlar to be a rigid rod,...

-

For an accrual-method partnership, are accounts receivable considered unrealized receivables? Explain.

-

Nareh began the year with a tax basis of $45,000 in her partnership interest. Her share of partnership liabilities consists of $6,000 of recourse liabilities and $10,000 of nonrecourse liabilities at...

-

A stone is launched vertically upward from a cliff 192 feet above the ground at a speed of 64 ft/s. Its height above the ground t seconds after the launch is given by s = -16t 2 + 64t + 192, for 0 t...

-

4. [Decision Trees] (6 pts) In class, we covered how to learn binary decision trees. In this question, you will modify the decision tree learning algorithm to obtain ternary decision trees (i.e, each...

-

One of the classical paradoxes of Zeno runs (more or less) as follows: A pair of dance partners are two units apart and wish to move together, each moving one unit. But for that to happen, they must...

-

Consider the following decision version of MIN SPANNING TREE MIN SPANNING TREE, DECISION VERSION Input: A graph G = (V, E) with positive edge weights e: E R>0, and a number k N Output: True if G...

-

53. Charle, a seller's agent, sells her client's home for $425,000. Her commission is 6.5%. Charle's total commission is: $267,250 $42,500 $2,762.50 O $27,625 Save and continue Revise question later

-

8. Rewrite the following statements using the symbol V and the variable x. a) Every real number is positive, negative, or zero. b) All students are eager to learn. 9. Rewrite the following statements...

-

What is the impact of the qualitative characteristic of 'materiality' on the preparation of the financial statements?

-

Solve each problem. Find the coordinates of the points of intersection of the line y = 2 and the circle with center at (4, 5) and radius 4.

-

What does it mean to characterize a gain or loss? Why is characterizing a gain or loss important?

-

Metro Corp. traded machine A for machine B. Metro originally purchased machine A for $50,000 and machine A's adjusted basis was $25,000 at the time of the exchange. What is Metro's realized gain or...

-

Metro Corp. traded machine A for machine B. Metro originally purchased machine A for $50,000 and machine A's adjusted basis was $25,000 at the time of the exchange. What is Metro's realized gain or...

-

Valve lead, valve lag and valve overlap contribute to increased: Question 6 options: 1) Stroke length 2) Compression ratio 3) Air entering cylinder per cycle 4) Mechanical efficiency Valve lead,...

-

La nica forma de cumplir con la obligacin de la fraccin III del artculo 99 de la Ley del Impuesto sobre la Renta, los contribuyentes enviarn a sus trabajadores el CFDI en un archivo con el formato...

-

What is scrap value? Question options: The value of an asset at the end of its useful life The value of an asset due to physical loss The value of an asset due to functional loss The value of an...

Study smarter with the SolutionInn App