Newman Corporation owns 90 shares of SP Corporation. The remaining 10 shares are owned by Kenny (an

Question:

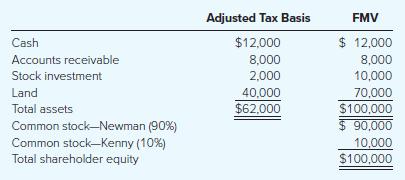

Newman Corporation owns 90 shares of SP Corporation. The remaining 10 shares are owned by Kenny (an individual). After several years of operations, Newman decided to liquidate SP Corporation by distributing the assets to Newman and Kenny. The tax basis of Newman’s shares is $10,000, and the tax basis of Kenny’s shares is $7,000. SP reported the following balance sheet at the date of liquidation:

a) Compute the gain or loss recognized by SP, Newman, and Kenny on a complete liquidation of the corporation, where SP distributes $10,000 of cash to Kenny and the remaining assets to Newman.

b) Compute the gain or loss recognized by SP, Newman, and Kenny on a complete liquidation of the corporation, where SP distributes the stock investment to Kenny and the remaining assets to Newman. Assume that SP’s tax rate is zero.

c) What form needs to be filed with the liquidation of SP?

Step by Step Answer:

Taxation Of Individuals And Business Entities 2023 Edition

ISBN: 9781265790295

14th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham