Woolard Supplies (a sole proprietorship) has taxable income in 2022 of $240,000 before any depreciation deductions (179,

Question:

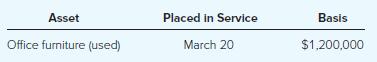

Woolard Supplies (a sole proprietorship) has taxable income in 2022 of $240,000 before any depreciation deductions (§179, bonus, or MACRS) and placed some office furniture into service during the year. The furniture does not qualify for bonus depreciation.

a) If Woolard elects $50,000 of §179, what is Woolard’s total depreciation deduction for the year?

b) If Woolard elects the maximum amount of §179 for the year, what is the amount of deductible §179 expense for the year? What is the total depreciation that Woolard may deduct in 2022? What is Woolard’s §179 carryforward amount to next year, if any?

c) Woolard is concerned about future limitations on its §179 expense. How much §179 expense should Woolard expense this year if it wants to maximize its depreciation this year and avoid any carryover to future years?

Step by Step Answer:

Taxation Of Individuals And Business Entities 2023 Edition

ISBN: 9781265790295

14th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham