Allison, Keesha, and Steven each own an equal interest in KAS Partnership, a calendar-year-end, cash-method entity. On

Question:

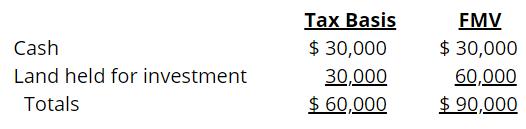

Allison, Keesha, and Steven each own an equal interest in KAS Partnership, a calendar-year-end, cash-method entity. On January 1 of the current year, Steven’s basis in his partnership interest is $27,000. During January and February, the partnership generates $30,000 of ordinary income and $4,500 of tax-exempt income. On March 1, Steven sells his partnership interest to Juan for a cash payment of $45,000. The partnership has the following assets and no liabilities at the sale date:

a. Assuming KAS’s operating agreement provides for an interim closing of the books when partners’ interests change during the year, what is Steven’s basis in his partnership interest on March 1 just prior to the sale?

b. What are the amount and character of Steven’s recognized gain or loss on the sale?

c. What is Juan’s initial basis in the partnership interest?

d. What is the partnership’s basis in the assets following the sale?

Step by Step Answer:

Taxation Of Individuals And Business Entities 2021

ISBN: 9781260247138

12th Edition

Authors: Brian Spilker, Benjamin Ayers, John Barrick, Troy Lewis, John Robinson, Connie Weaver, Ronald Worsham