David Deans started trading as a painter and decorator on 1 July 2020. He has notified you

Question:

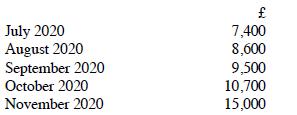

David Deans started trading as a painter and decorator on 1 July 2020. He has notified you of his turnover each month which, up to November 2020, has been as follows:

In anticipation of a meeting with Mr Deans, you have received a letter from him, of which the following is an extract:

"In preparation for our meeting, I have some further information for you and some questions which I hope you will be able to answer for me. I anticipate that my turnover is likely to be £16,000 in December 2020 and £18,500 in January 2021. It must be reaching the time at which I need to be registered for VAT. Could you give me some idea of when this might be and whether I could delay it so as to improve my cash flow?

Since starting business I have purchased substantial quantities of stock. Will I be able to recover any of the VAT I have paid?

In June next year, I intend to buy a new van and a new car for the business. Their cost, including VAT, will be £30,000 and £18,000 respectively. I assume that I will be able to recover the VAT on both items. The van will be used wholly for business and the car for both business and private use. The firm will pay for all the petrol used by both vehicles. As yet, I have not suffered any bad debts but as the business expands there is always the risk that they might arise. Are there any special VAT arrangements to deal with them?"

Required:

Draft notes in preparation for the meeting with Mr Deans, responding to the queries which he has raised.

Step by Step Answer: