Sanjay began trading on 1 February 2017, selling standard -rated goods and services. He decided not to

Question:

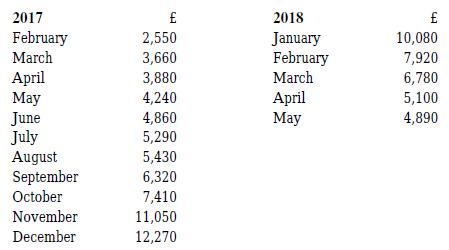

Sanjay began trading on 1 February 2017, selling standard -rated goods and services. He decided not to register for VAT voluntarily. His turnover (excluding VAT) for the first 16 months of trading was as follows:

In January 2018 , he sold a machine (which had been used as a non -current asset) for £800. This is not included in the above turnover figures.

Sanjay is worried that his monthly turnover has started to fall and he is considering offering customer discounts in an attempt to reverse this trend.

Required:

(a) Explain the term "taxable person" for VAT purposes.

(b) State the circumstances in which VAT registration is compulsory and explain why some persons may choose to register voluntarily.

(c) State the date by which Sanjay would be required to register for VAT. Would registration be necessary if his monthly turnover for the remainder of 2018 seemed likely to continue on a downward trend?

(d) Explain the VAT consequences which would ensue if Sanjay began offering trade discounts or cash discounts to his customers.

Step by Step Answer: