You have been assigned to compute the income tax provision for Motown Memories, Inc. (MM) as of

Question:

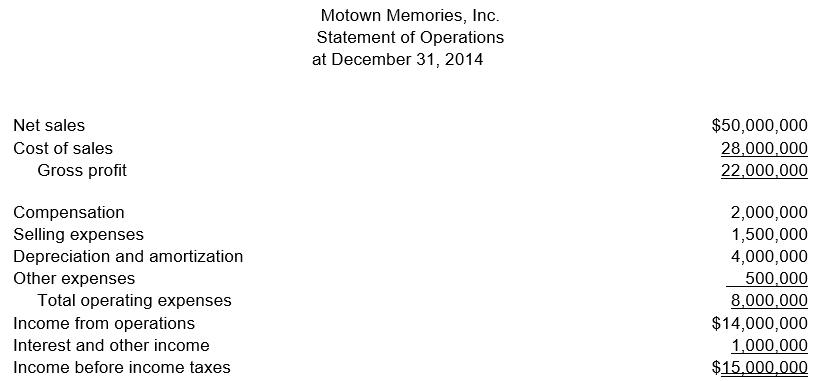

You have been assigned to compute the income tax provision for Motown Memories, Inc. (MM) as of December 31, 2014. The Company’s federal income tax rate is 34%. The Company’s Income Statement for 2014 is provided below:

You have identified the following permanent differences:

Interest income from municipal bonds: $50,000

Nondeductible meals and entertainment expenses: $20,000

Domestic production activities deduction (DPAD): $250,000

Nondeductible fines: $5,000

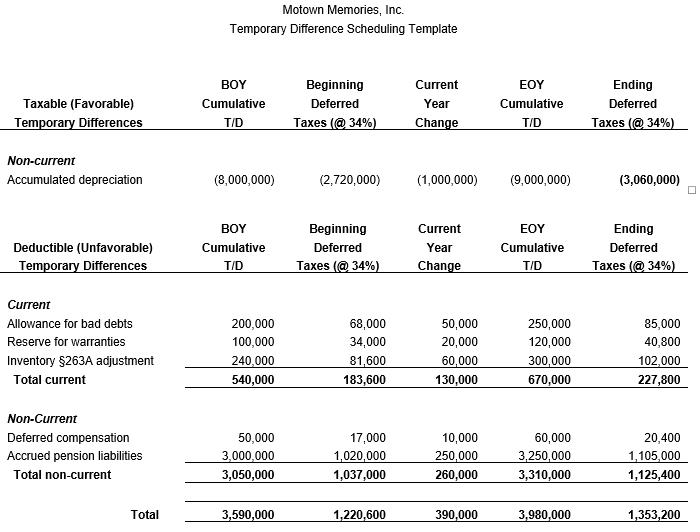

MM prepared the following schedule of temporary differences from the beginning of the year to the end of the year:

a. Compute MM’s current income tax expense or benefit for 2014.

b. Compute MM’s deferred income tax expense or benefit for 2014.

c. Prepare a reconciliation of MM’s total income tax provision with its hypothetical income tax expense in both dollars and rates.

Step by Step Answer:

Taxation Of Individuals And Business Entities 2015

ISBN: 9780077862367

6th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver