In 2014, Shaun bought 20% of the ordinary shares of an unlisted trading company. The shares cost

Question:

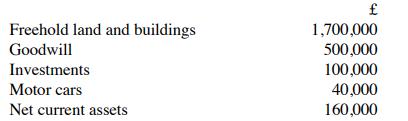

In 2014, Shaun bought 20% of the ordinary shares of an unlisted trading company. The shares cost £140,000. He owned the shares until January 2022 when he gave all the shares to a friend. On the date of the gift, the shares had a market value of £500,000 and the company's assets were valued as follows:

Calculate the chargeable gain, assuming that both Shaun and his friend elect that the gain arising should (as far as possible) be held-over.

Transcribed Image Text:

Freehold land and buildings Goodwill Investments Motor cars Net current assets 1,700,000 500,000 100,000 40,000 160,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

On 6 April 2021, Harry Johnson, aged 38, started employment with, Queens words Ltd as a proof-reader. On the 11 January 2022, Harry also entered into a partnership with his friend Debra. Together...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Aquatic Biotechnology Inc. (ABI) is a medium-sized, public company operating an aquaculture business in eastern Canada. The company has been in operation since the mid-1990s, and during the latter...

-

A compound with molecular formula C 17 H 36 exhibits a 1 H NMR spectrum with only one signal. How many signals would you expect in the 13C NMR spectrum of this compound?

-

How do relative and specific humidities change during a simple heating process? Answer the same question for a simple cooling process.

-

A cube has 2 faces painted red, 2 painted white, and 2 painted blue. What is the probability of getting a red face or a white face in one roll?

-

In the benzene adsorber of Example 9.7, the flow rate is increased to \(0.25 \mathrm{~m}^{3} / \mathrm{s}\). Calculate the breakthrough time and the fraction of the bed adsorption capacity that has...

-

Last year (2013), Richter Condos installed a mechanized elevator for its tenants. The owner of the company, Ron Richter, recently returned from an industry equipment exhibition where he watched a...

-

Annual sales (in millions of units) of a certain brand of tablet computers are expected to grow in accordance with the function f ( t ) = 0.18 t 2 + 0.16 t + 2.64 (0 t 4) per year, where t is...

-

Which series has the highest beta. BraveNewCoin Liquid Index for Bitcoin 1D BNC Trading Brave Ne Yellow Green Blue Orange

-

Identify the accounting periods relating to the following periods of account: (a) year to 30 November 2021 (c) 1 January 2022 to 31 January 2022 (e) 1 April 2020 to 30 September 2021. (b) 1 October...

-

Calculate the CGT payable in relation to each of the following disposals, assuming in each case that the annual exemption is fully utilised against other gains, that there are no allowable losses and...

-

Vista Distributors purchases inventory in crates of merchandise. Assume the company began July with an inventory of 30 units that cost $300 each. During the month, the company purchased and sold...

-

Describe how a firm would establish reordering levels. Include consumption-based ordering. Include how firms use inventory turns. How would the firm establish safety, buffer, and seasonal stock...

-

How Customer Service can make an huge impact in future supply chain of warehouses. Some key factors on how Customer service can give a competitive edge to a company over others?

-

Thorough comments and please code in Java so that I may understand: Q1. You are tasked with building a website showing all dogs that your organization currently knows of that are waiting to be placed...

-

Which of the four freight flows (Millions of Markets, Global Market place, One world order, Naftastique) should the Tractor Supply Company prepare itself for and what should they do to prepare for...

-

What are the target markets for Shopper Drug mart, Please give 5 examples. But regarding the types of target market: geographic; demographic, pisychosocial; feelings and behavior; geodemographic;...

-

Brainstorming Tips for Productive Sessions Casandra M., your supervisor at Gap Inc., has been asked to lead a brainstorming group in an effort to generate new ideas for the companys product line....

-

The ultimate goal of Google, Bing, and other consumer search engines is to provide users with search listings that contain useful information on the topic of their search. What recommendations would...

-

In the year to 31 March 2018, a UK resident company had UK trading profits of 5, 450,000 and overseas property income (net of 35% withholding tax) of 130,000. Compute the corporation tax liability...

-

On 1 November 2017 , a UK company receives a non -exempt dividend from an overseas company (in which it has 15% voting power) of 10,500, net of 30% withholding tax. The income statement of the...

-

Amy is domiciled in the UK and has lived in the UK all her life. On 1 January 2017 she leaves to work in Australia for two years, returning on 31 December 2018. During her absence she makes no visits...

-

How do religious institutions operate as socialization agents, transmitting moral values, belief systems, and rituals that contribute to individual and collective identity formation?

-

If x is the average (arithmetic mean) of m and 9, y is the average of 2m and 15, and z is the average of 3m and 18, what is the average of x, y, and z in terms of m?

-

1. Part U16 is used by Mcvean Corporation to make one of its products. A total of 18,000 units of this part are produced and used every year. The company's Accounting Department reports the following...

Study smarter with the SolutionInn App