John dies on 3 March 2022. Between 6 April 2021 and 3 March 2022, he has capital

Question:

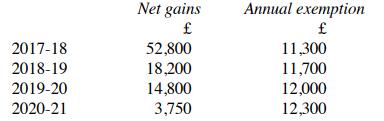

John dies on 3 March 2022. Between 6 April 2021 and 3 March 2022, he has capital gains of £1,200 and capital losses of £15,400. His net gains in recent tax years (and the annual exemption for each year) have been as follows:

Explain how (and to what extent) John's net losses in 2021-22 will be relieved.

Transcribed Image Text:

2017-18 2018-19 2019-20 2020-21 Net gains 52,800 18,200 14,800 3,750 Annual exemption 11,300 11,700 12,000 12,300

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

The question is related to the treatment of capital gains and losses for tax purposes in the UK As per the UK tax rules individuals are entitled to an ...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Explain the meaning of the terms emoluments, employments and office for the purposes of PAYE as you earn systems. 2. Explain the actual receipts basis of assessing the emoluments from the employment...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

A bakery with a December 31 st year end purchased new equipment on October 31 st 2000 for $10,000. This was their first equipment purchase. Required: What are the tax consequences if the equipment is...

-

Social welfare is maximized when O Total social benefits have been maximized O total social costs have been minimized O total social costs equal total social benefits O marginal social costs equal...

-

Exercise 6-22 gave data on the heights of female engineering students at ASU. (a) Can you support a claim that mean height of female engineering students at ASU is 65 inches? Use a = 0.05 (b) What is...

-

Kilarney, a foreign corporation, is incorporated in Country J and is 100%-owned by Maine, a domestic corporation. During the current year, Kilarney earns $500,000 from its Country J operations and...

-

The Burj Khalifa in Dubai is 2,717 feet tall, making it the worlds tallest building. For each statement, briefly discuss possible sources of error in the measurement. Then, considering the precision...

-

An investor in the 35 percent tax bracket may purchase a corporate bond that is rated double A and is traded on the New York Stock Exchange (the bond division). This bond yields 9.0 percent. The...

-

2. Write the output of the program given below. (20 Points) #include void main(void){ int b[] = {10, 20, 30, 40 }; int *bPtr = b; int i; for (i=0; i <4; i++) { for (i=0; i <4; i++) printf("bPtr [%d]...

-

On what date is CGT for 2021-22 normally due for payment?

-

An individual has capital losses brought forward from previous years amounting to 4,800. Compute the individual's taxable gains for 2021-22 if total gains and losses for the year are as follows:...

-

Find at least an additional 5 to 7 more scholarly sources to include in your literature review. List each resource and briefly describe how each will be added to your literature review. In other...

-

Once you create a budget, it is important to be responsible and follow it. Explain why following a budget is important, and describe what could happen if you don't follow it?

-

Imagine that you are a parent with young children. You want to get life insurance covering your children's lives until they are old enough to produce their own incomes and buy their own insurance....

-

Using the Internet , thoroughly summarize a response Why is it important to record sales transactions in the correct transaction category for QuickBooks Online? Include the web address of your source.

-

How do individuals become involved with social norm groups and How do sociologists explain the differences in social norm? Explain

-

By 1927 the ease of credit had accounted for what percent of American automobile purchases?

-

Bountiful Manufacturing produces two types of bike frames (Frame X and Frame Y). Frame X passes through four processes: cutting, welding, polishing, and painting. Frame Y uses three of the same...

-

Horse serum containing specific antibody to snake venom has been a successful approach to treating snakebite in humans. How do you think this anti-venom could be generated? What are some advantages...

-

The following information relates to three companies that use the revaluation model in relation to intangible assets and prepare annual financial statements to 31 December: (a) Company W acquired an...

-

There are two international standards which deal with goodwill . IAS38 does not allow internally generated goodwill to be recognised as an asset. Goodwill acquired in a business combination is dealt...

-

An asset which cost £200,000 on 1 January 2016 is being depreciated on the straight line basis over a five year period with an estimated residual value of £40,000. The company which owns...

-

What funding (including date and amount) has Right Now received? What are the pros and cons for Right Now Technologies of the 3 options (be acquired, IPO, continue as independent) Suggest one...

-

Eleazar uses the aging method to record bad debt at the end of each fiscal year on December 31. This year, he made sales on account of $100,000, none of which he has collected. He also has...

-

A shareholder has a personal service business corporation. What rate of federal tax may be expected on taxable income?

Study smarter with the SolutionInn App