Consider a 5% 14-year bond with a maturity value of $100 that is option free and is

Question:

Consider a 5% 14-year bond with a maturity value of $100 that is option free and is selling to yield 6%.

a. What is the bond’s price?

b. What is the price value of a basis point for this bond?

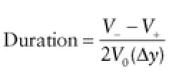

c. What is the bond’s duration using the formula given by equation (17.5) and changing interest rates by 10 basis points?

d. Is the duration calculated in (c) a modified duration or an effective duration? Explain why?

e. If market yields change by 100 basis points, what is the approximate percentage change in the bond’s price?

f. If market yields change by 25 basis points, what is the approximate percentage change in the bond’s price?

g. If market yields increase by 50 basis points, what is the approximate dollar price per $100 of par value of this bond?

Step by Step Answer:

The Theory And Practice Of Investment Management

ISBN: 9780470929902

2nd Edition

Authors: Frank J Fabozzi, Harry M Markowitz