Consider the following two 10-year corporate bonds that are currently callable: Suppose that the current market yield

Question:

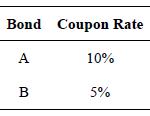

Consider the following two 10-year corporate bonds that are currently callable:

Suppose that the current market yield for 10-year corporate bonds is 7%.

a. Which of these two bonds would be expected to exhibit negative convexity?

b. For which of these two bonds would it be more appropriate to use modified duration rather than effective duration.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

The Theory And Practice Of Investment Management

ISBN: 9780470929902

2nd Edition

Authors: Frank J Fabozzi, Harry M Markowitz

Question Posted: