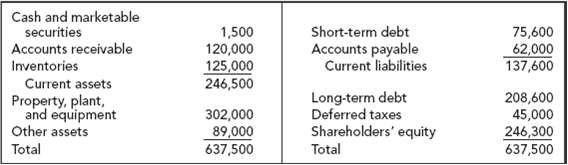

Question: Table 19.3 shows a simplified balance sheet for Rensselaer Felt. Calculate this company?s weighted-average cost of capital. The debt has just been refinanced at an

Table 19.3 shows a simplified balance sheet for Rensselaer Felt. Calculate this company?s weighted-average cost of capital. The debt has just been refinanced at an interest rate of 6 percent (short term) and 8 percent (long term). The expected rate of return on the company?s shares is 15 percent. There are 7.46 million shares outstanding, and the shares are trading at $46. The tax rate is 35 percent.

Cash and marketable securities Accounts receivable Short-term debt Accounts payable Current liabilities 1,500 120,000 75,600 62,000 137,600 Inventories Current assets 125,000 246,500 Long-term debt Deferred taxes Shareholders' equity 208,600 45,000 Property, plant, and equipment Other assets Total 302,000 89,000 637,500 246,300 637,500 Total

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

We make three adjustments to the balance sheet Ignore deferred taxe... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-D-P (58).docx

120 KBs Word File