The Accounting Cycle and Preparation of Financial Statements Including a Statement of Cash Flows Haskins Supply, Inc.,

Question:

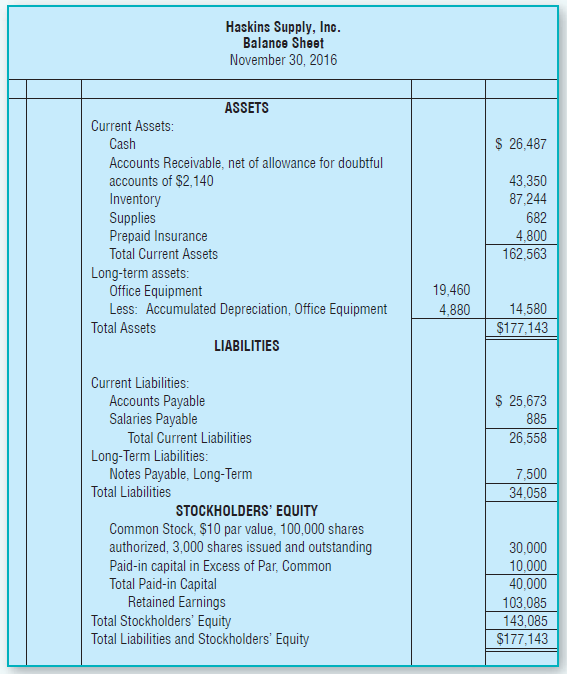

The Accounting Cycle and Preparation of Financial Statements Including a Statement of Cash Flows Haskins Supply, Inc., supplies industrial tools to local businesses. Haskins Supply's November 30, 2016 Balance Sheet appears as:

During the month of December 2016, Haskins Supply, Inc., had the following transactions:

Dec 2 Paid the balance in Salaries Payable

3 Purchased $2,450 of inventory on account from Ensco, Inc Terms. 2/10, n/30. FOB shipping point.

4 Paid freight charges of S160 on December 3 purchase from Ensco, Inc.

5 Purchased $400 of supplies on account from OfficeMaxx. Terms. 3/15, n/30, FOB destination.

9 Sold merchandise costing $1,120 to Allied, Inc. on account for $2,760 Terms, 2/10, n/30. FOB destination.

10 Paid $140 freight charges to deliver goods to Allied, Inc.

11 Paid amount owed to Ensco. Inc. on the December 3 purchase in full.

12 Sold 1.500 shares of common stock for $22,000

13 Sold merchandise costing $5,310 to a cash customer for $12,870

14 Received $4,240 from Noxon, Inc. as payment on a November 16 sale.

Terms were n/30.

15 Granted a S360 allowance to Allied, Inc. on the December 9 sale due to

damaged merchandise,

15 Purchased a delivery vehicle for $22,500, paying $5,000 cash and signing a 7%. 5-year, note payable for $17,500. The note requires annual payments of $3,500 plus interest on December 15 of each year, beginning in 2017.

18 Received payment in full from Allied, Inc.. for the December 9 sale.

19 Paid for the supplies purchased on December 5

22 Declared a $2 per share cash dividend

24 Sold office equipment for $1,000. Equipment originally cost $2,300 and had accumulated depreciation of $1,500

26 Paid $2,360 on account to Donovan. Inc. on a November 8 purchase.

Terms were 2/15, net 60.

27 Wrote off the S980 account of XCR. Inc. as uncollectible.

28 Paid $7,500 on the long-term note payable plus interest. The note was a 1-year, 6% note dated December 28. 2015. No interest has been recorded to this point.

30 Paid current month’s rent. $1,400

31 Paid sales commissions, $1,370.

31 Paid the dividend declared on December 22.

Requirements

1. Open four-column general ledger accounts and enter the balances from the November 30 trial balance.

2. Record each transaction in the general journal. Explanations are not required. Post the journal entries to the general ledger, creating new ledger accounts as necessary. Omit posting references. Calculate the new account balances.

3. Prepare an unadjusted trial balance as of December 31, 2016.

4. Journalize and post the adjusting journal entries based on the following information, creating new ledger accounts as necessary:

a. Depreciation on office equipment for the month is $146 and on vehicles is $375.

b. Supplies on hand at December 31, $283.

c. Accrued salary expense for the office receptionist is $1,025.

d. Accrue interest on the December 15, $17,500 note payable (round to the nearest dollar).

e. The balance in prepaid insurance represents a six-month insurance policy that was purchased on November 30 of the current year.

f. Based on an aging of Accounts Receivable, Haskins Supply estimates uncollectible accounts will equal $2,830.

5. Prepare an adjusted trial balance as of December 31, 2016. Use the adjusted trial balance to prepare Haskins Supply, Inc.’s multi-step income statement and statement of retained earnings for the month ending December 31, 2016. Also, prepare the comparative balance sheet at December 31, 2016. Use the financial statements and the monthly transaction data to prepare Haskins Supply’s statement of cash flows for the month ending December 31, 2016, using the indirect method.

6. Journalize and post the closing entries.

7. Prepare a post-closing trial balance at December 31, 2016?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: