Question: The following operating data (in thousands) were adapted from the SEC 10-K filings of Walgreen and CVS: 1. Using the preceding data, adjust the operating

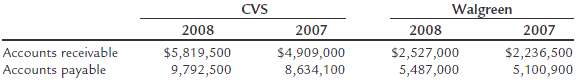

The following operating data (in thousands) were adapted from the SEC 10-K filings of Walgreen and CVS:

1. Using the preceding data, adjust the operating income for CVS and Walgreen to an adjusted cash basis. For 2008, the operating income for CVS was $6,046,200 and for Walgreen?s it was $3,441,000 (in thousands).

2. Compute the net difference between the operating income under the accrual and cash bases.

3. Express the net difference in (2) as a percent of operating income under the accrual basis.

4. Which company?s operating income, CVS?s or Walgreen?s, is closer to the cash basis? Round to one decimal place.

5. Do you think most analysts focus on operating income or net income in assessing the long-term profitability of a company? Explain.

CVS Walgreen 2007 2008 2007 2008 Accounts receivable Accounts payable $2,236,500 5,100,900 $5,819,500 9,792,500 $4,909,000 8,634,100 $2,527,000 5,487,000

Step by Step Solution

3.52 Rating (176 Votes )

There are 3 Steps involved in it

1 2 CVS 247900 6294100 6046200 Walgreen 95600 3536600 3441000 3 CVS 41 247900 6046200 Walgreen 28 95... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

59-B-A-I-A (628).docx

120 KBs Word File