Question: Using the information provided in P22-13, prepare the cash flow statement and all required disclosures for American Safety Products using the direct method. In P22-13

Using the information provided in P22-13, prepare the cash flow statement and all required disclosures for American Safety Products using the direct method.

In P22-13

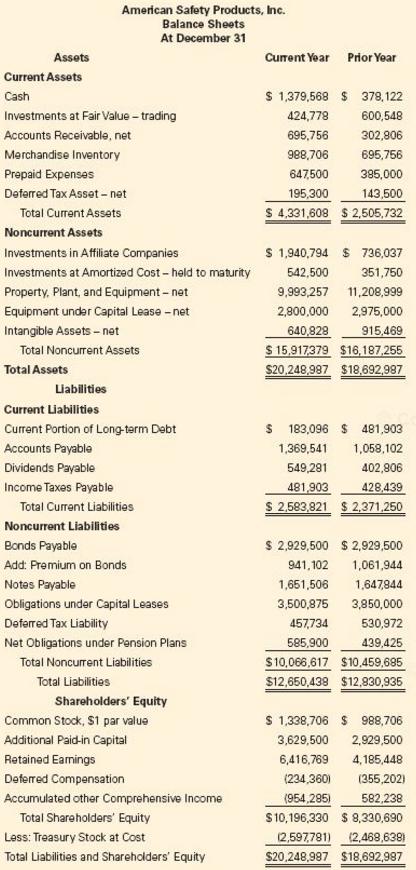

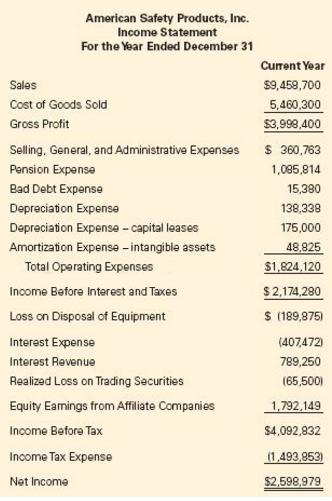

American Safety Products, Inc. provided the following comparative balance sheets and income statement for the current year.

American Safety Products, Inc. Balance Sheets At December 31 Assets Current Year Prior Year Current Assets Cash Investments at Fair Value trading Accounts Receivable, net Merchandise Inventory Prepaid Expenses Deferred Tax Asset- net S 1,379,568 S 378,122 424,77 600,548 65,758 30 306 988,706 695,756 647500 385,000 95,300 143,500 S 4,331,608 2,505,732 Total Current Assets Noncurrent Assets Investments in Affiliate Companies Investments at Amortized Cost held to maturity Property, Plant, and Equipment net Equipment under Capital Lease -net Intangible Assets-net S 1,940,794 736,037 351,750 542,500 9,893,257 11,20,9e 2.800,000 2.975,000 40,828915459 Total Noncurrent Assets Total Assets S20.248.997 $18.692.987 Liabilities Current Liabilities Current Portion of Long-term Debt Accounts Payable Dividends Payable Income Taxes Payable S 183,096 481,903 1,369,541 1,058,102 549281 402,806 481.903428439 Total Current Liabilities Noncurrent Liabilities Bonds Payable Add: Premium on Bonds S 2,583,821 $2,371,250 s 2,929,500 2,929,500 941.102 ,061,944 1,651,506 1,647844 3,500,875 3,850,000 457,734 530,972 439,425 $10,066,617 $10,459,685 $12,650,438 $12.,830,935 Obligations under Capital Leases Deferred Tax Liability Net Obligations under Pension Plans Total Noncurrent Liabilities Total Liabilities Shareholders' Equity Common Stock, $1 par value Additional Paid-in Capital Retained Earnings Deferred Compensation Accumulated other Comprehensive Income S 1,338,706 S 988,706 3,629,500 2,929,500 6,416,769 4,185,448 234,360 (355,202) 954,285) 582,238 S10,196,330 $ 8,330,690 597781) 12,468,6381 S20.248.987 $18,692,987 Total Shareholders' Equity Less: Treasury Stock at Cost Total Liabilities and Shareholders Equity American Safety Products, Inc. Income Statement For the Year Ended December 31 Sales Cost of Goods Sold Gross Profit Current Year 59,458,700 5,460,300 $3,998.400 Selling, General, and Administrative Expenses 360,763 1,085,814 15,380 138,338 175,000 48,825 $1,824.120 2,174,280 S (189.878 407472 789,250 65,500 1,792,149 $4,092,832 1,493,853) $2,598,979 Pension Expense Bad Debt Expense Depreciation Expense Depreciation Expense capital leases Amortization Expense -intangible assets Total Operating Expenses Income Before Interest and Taxes Loss on Disposal of Equipment Interest Expense Interest Revenue Realized Loss on Trading Securities Equity Earmings from Affiliate Companies Income Before Tax Income Tax Expense Net Income

Step by Step Solution

3.44 Rating (179 Votes )

There are 3 Steps involved in it

Analysis of Balance Sheet Changes and Cash Flow Classification Assets Current Year Prior Year Change Classification Current Assets Cash 1379568 378122 1001446 Answer Investments at Fair ValueTrading 4... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

578-B-A-B-S-C-F (1977).docx

120 KBs Word File