Question: Wiley Companys income statement for Year 2 follows: The companys selling and administrative expense for Year 2 includes $7,500 of depreciation expense. Selected balance sheet

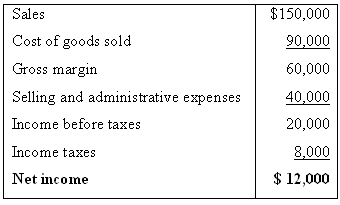

Wiley Company’s income statement for Year 2 follows:

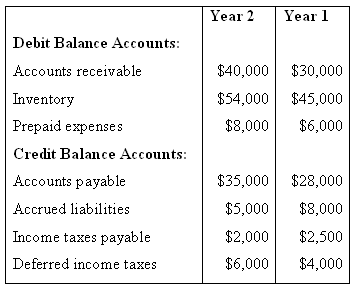

The company’s selling and administrative expense for Year 2 includes $7,500 of depreciation expense. Selected balance sheet accounts for Wiley at the end of Years 1 and 2 are as follows:

Required:

- Using the direct method, convert the company’s income statement to a cash basis.

- Assume that during Year 2 Wiley had a $9,000 gain on sale of investments and a $3,000 loss on the sale of equipment. Explain how these two transactions would affect your computations in (1) above.

$150,000 Sales Cost of goods sold 90,000 Gross margin 60,000 Selling and administrative expenses 40,000 Income before taxes 20,000 Income taxes 8,000 $ 12,000 Net income

Step by Step Solution

3.43 Rating (181 Votes )

There are 3 Steps involved in it

1 Sales 150000 Adjustments to a cash basis Increase in accounts receivable 10000 1400... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-S-C-F (28).docx

120 KBs Word File