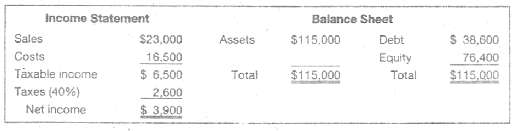

Question: EFN the most recent financial statements for Last in Line, Inc., are shown here: Assets and costs are proportional to sales. Debt and equity are

EFN the most recent financial statements for Last in Line, Inc., are shown here: Assets and costs are proportional to sales. Debt and equity are not. A dividend of $1,560 was paid, and the company wishes to maintain a constant payout ro. Next year??s sales are projected to be $27,600. What is the external financing needed?

Balance Sheet Debt Equity Total Income Statement $23,000 Assels Sales Costs Taxable income Taxes (40%) $ 38,600 $115.000 16.500 76,400 Total $ 6,500 $115.000 $115,000 2,600 $ 3,900 Net income

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

An increase of sales to 27600 is an increase of Sales increase 27600 23000 23000 Sa... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

29-B-C-F-F-S (54).docx

120 KBs Word File