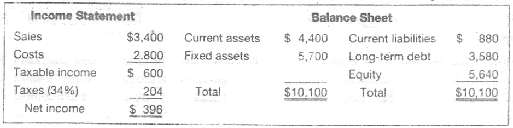

Question: EFN The most recent financial statements tor 7 Seas, Inc., are shown here: Assets, costs, and current liabilities are proportional to sales. Long-term debt and

EFN The most recent financial statements tor 7 Seas, Inc., are shown here: Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant 50 percent dividend payout ratio. As with every other firm in its industry, next year??s sales are projected to increase by exactly 15 percent. What is the external financing needed?

Income Statement Saies Balance Sheet $ 4,400 Current liabilities 5,700 Long-term deb! Equity Current assets Fixed assels $ 600 $3,400 880 3,580 5,640 Costs Taxable income Taxes (34%) 2.800 204 Total $10.100 $10,100 Total Net income $ 396

Step by Step Solution

3.40 Rating (178 Votes )

There are 3 Steps involved in it

Assuming costs and assets increase proportionally the pro form... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

29-B-C-F-F-S (55).docx

120 KBs Word File