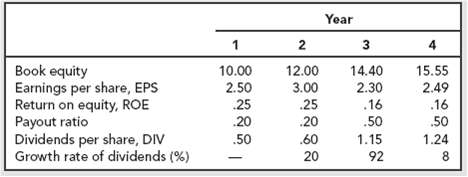

Look again at Tables 4.3 (Growth-Tech) and 4.7 (Concatenator Manufacturing). Note the discontinuous increases in dividends and

Question:

Look again at Tables 4.3 (Growth-Tech) and 4.7 (Concatenator Manufacturing). Note the discontinuous increases in dividends and free cash flow when asset growth slows down. Now look at your answer to Practice Question 11: Dividends are expected to grow smoothly, although at a lower rate after year 3. Is there an error or hidden inconsistency in Practice Question 11? Write down a general rule or procedure for deciding how to forecast dividends or free cashflow.

Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers

Question Posted: