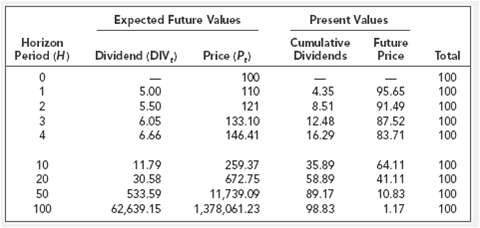

Question: Look one more time at Table 4.1, which applies the DCF stock valuation formula to Fledgling Electronics. The CEO, having just learned that stock value

Look one more time at Table 4.1, which applies the DCF stock valuation formula to Fledgling Electronics. The CEO, having just learned that stock value is the present value of future dividends, proposes that Fledgling pay a bumper dividend of $15 a share in period 1. The extra cash would have to be raised by an issue of new shares. Recalculate Table 4.1 assuming that profits and payout ratios in all subsequent years are unchanged. You should find that the total present value of dividends per existing share is unchanged at $100.Why?

Expected Future Vakues Present Values Horizon Cumulative Dividends Future Price Dividend (DIV,) Price (P) Total Period (H) 100 110 121 133.10 146.41 100 100 100 100 100 5.00 5.50 6.05 6.66 4.35 8.51 12.48 16.29 95.65 91.49 87.52 83.71 259.37 672.75 11,739.09 1,378,061.23 10 20 50 100 11.79 30.58 35.89 58.89 64.11 100 100 100 100 41.11 89.17 533.59 10.83 62,639.15 98.83 1.17 88888 8888 01234

Step by Step Solution

3.48 Rating (171 Votes )

There are 3 Steps involved in it

In order to pay the extra dividend the company needs to raise an extra 10 pe... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-P-V (73).docx

120 KBs Word File