Question: Sapasco Industries Ltd. is a Canadian-controlled private corporation that manufactures a small line of plastic containers. The company has been in existence for only nine

Sapasco Industries Ltd. is a Canadian-controlled private corporation that manufactures a small line of plastic containers. The company has been in existence for only nine years but has grown rapidly. Last year, sales reached $8,000,000, and a record high profit of $750,000 was achieved.

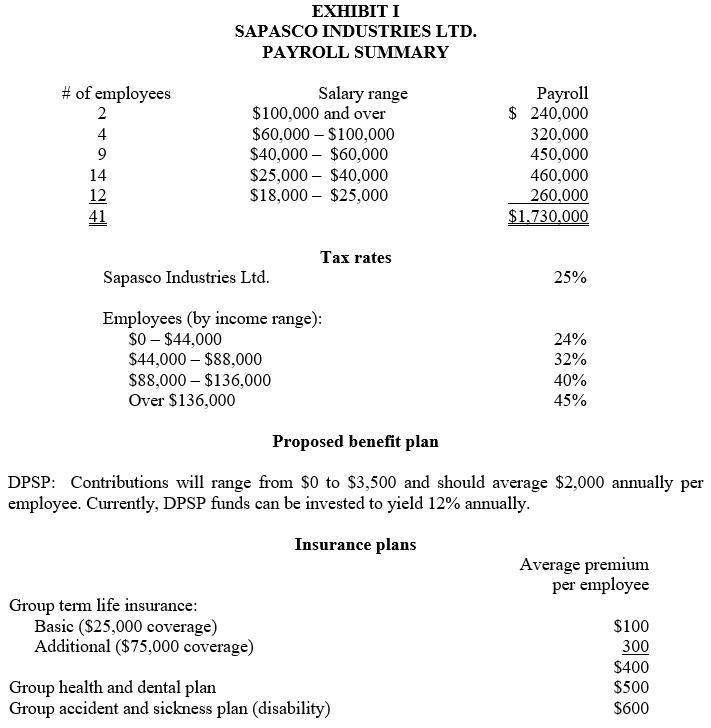

The company now employs 41 staff in addition to the president, who is the sole shareholder. The current annual payroll, exclusive of the income of the shareholder/president, is $1,730,000 and consists of salaries, bonuses, and compulsory benefits, such as Canada Pension Plan and Employment Insurance contributions. The company is concerned about its increasing payroll costs, especially since recent wage increases in their industry have averaged 10%. The company’s year-end is approaching, and Sapasco must soon decide on salary adjustments for its existing staff.

Not long ago, Sapasco was approached by an insurance company, which suggested that it start up an employee benefit plan, which would include a deferred profit-sharing plan and three basic insurance plans. The insurance company indicated that if the insurance plans were accepted as a group, it could reduce the annual premiums by 20% of the normal retail rate. Also, it could invest the deferred profit-sharing plan funds to yield an average return 1% higher than that earned by individuals who invest separately in RRSPs.

The president of Sapasco has asked Carol Asaki, the personnel manager, to review the insurance company’s proposal. The president tells her, “I have always felt that excessive benefit programs create more administrative headaches than they are worth. But I’m willing to look at them further in view of the large wage settlements we may be facing. Let me know the value of the proposal to us as well as to the employees.”

To prepare her report to the president, Asaki gathers together certain information, which is summarized in Exhibit I. In addition, she pulls the personnel file on one of the company’s employees. The information in this file is summarized in Exhibit II.

Required:

On behalf of Asaki, prepare a draft report for the president.

EXHIBIT II

SAPASCO INDUSTRIES LTD.

Summary of Personnel File

Jason Steiman

Age: 33

Family status: Married, three children

Current salary: $50,000

Amounts withheld from salary

• Canada Pension Plan

• Employment Insurance

• Monthly contributions made directly to employee’s bank for the purchase of his private RRSP ($200 per month).

EXHIBIT I SAPASCO INDUSTRIES LTD. PAYROLL SUMIMARY # of employees Salary range $100,000 and over $60,000 $100,000 $40,000 $60,000 $25,000 $40,000 $18,000 $25,000 yroll $ 240,000 320,000 450,000 2 4 9 14 460,000 12 41 260.000 $1.730.000 Tax rates Sapasco Industries Ltd. 25% Employees (by income range): s0 - $44,000 $44,000 $88,000 S88,000 $136,000 Over $136,000 24% 32% 40% 45% Proposed benefit plan DPSP: Contributions will range from $0 to $3,500 and should average $2,000 annually per employee. Currently, DPSP funds can be invested to yield 12% annually. Insurance plans Average premium per employee Group term life insurance: Basic ($25,000 coverage) Additional ($75,000 coverage) $100 300 $400 $500 $600 Group health and dental plan Group accident and sickness plan (disability)

Step by Step Solution

3.29 Rating (158 Votes )

There are 3 Steps involved in it

The proposed benefit plan includes both a deferred profit sharingplan and several types of group insurance plans The general benefits of these two plans are reviewed separately asthe tax implications ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

691-L-B-L-I-T-E (631).docx

120 KBs Word File