From the transactions shown below, enter the appropriate journal abbreviation next to each transaction. Using the information

Question:

From the transactions shown below, enter the appropriate journal abbreviation next to each transaction.

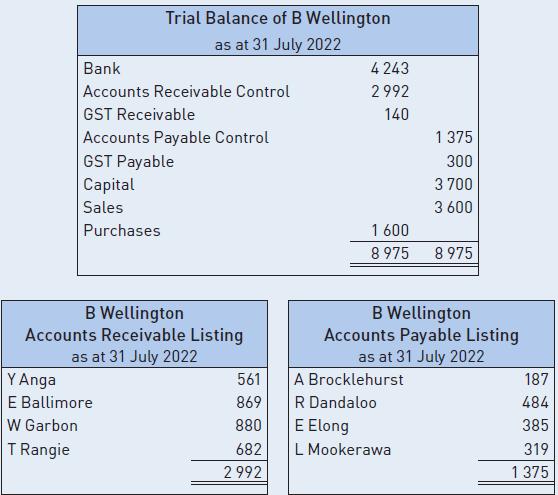

Using the information (shown in figure 6.92) and transactions, prepare the journals of B Wellington for August 2022. Post the journals to the general, accounts receivable and accounts payable ledgers using the relevant account format. Prepare a trial balance and appropriate listings for the subsidiary ledgers as at 31 August 2022.

__________ 1 Allowed W Garbon $33 discount as the July account was settled in full.

__________ 1 Direct deposit received from T Rangie $682 for July account.

__________ 1 Remitted funds to R Dandaloo for $440 in full settlement of July purchases.

__________ 1 Electronic transfer to pay E Elong’s July account and took $11 off as discount.

__________ 2 Received funds from Y Anga in full settlement of July account.

__________ 2 Sold goods for cash to Maryvale Co-op $1870 ($1700 + $170 GST).

__________ 5 Purchased stock from Montefiores and Co $528 ($480 + $48 GST) and paid by a debit card.

__________ 5 Received adjustment credit note for $22 ($20 + $2 GST) from A Brocklehurst for over-pricing.

__________ 6 Funds were remitted to L Mookerawa for all of last month’s purchases.

__________ 7 E Ballimore paid July account.

__________ 10 Sold goods to W Garbon $1848 ($1680 + $168 GST).

__________ 12 Paid electronically $165 to A Brocklehurst being the amount now owed on account.

__________ 13 Sent adjustment credit note to W Garbon for goods returned $143 ($130 + $13 GST).

__________ 15 Goolma Supplies bought inventory by payment for $1980 ($1800 + $180 GST).

__________ 15 L Mookorawa forwarded tax invoice $385 ($350 + $35 GST) for stocks obtained.

__________ 18 Y Anga took stock on credit for $2640 ($2400 + $240 GST).

__________ 18 Dripstone Co sold goods to B Wellington $649 ($590 + $59 GST).

__________ 19 Tax invoiced T Rangie for goods $2904 ($2640 + $264 GST).

__________ 19 Mailed tax invoice for $1716 ($1560 + $156 GST) to Bakers Swamp Co for inventory supplied.

__________ 20 Bought goods for $451 ($410+ $41 GST) from R Dandaloo.

__________ 20 Sent tax invoice $1991 ($1810 + $181 GST) to Y Anga for inventory taken.

__________ 25 Sold goods $2761 ($2510 + $251 GST) to E Ballimore.

__________ 25 Received tax invoice for $1254 ($1140 + $114 GST) from E Elong for stock purchases.

__________ 25 Goods sold on credit to W Garbon for $2563 ($2330 + $233 GST).

__________ 30 W Garbon bought inventory $1969 ($1790 + $179 GST) on credit.

Step by Step Answer:

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson