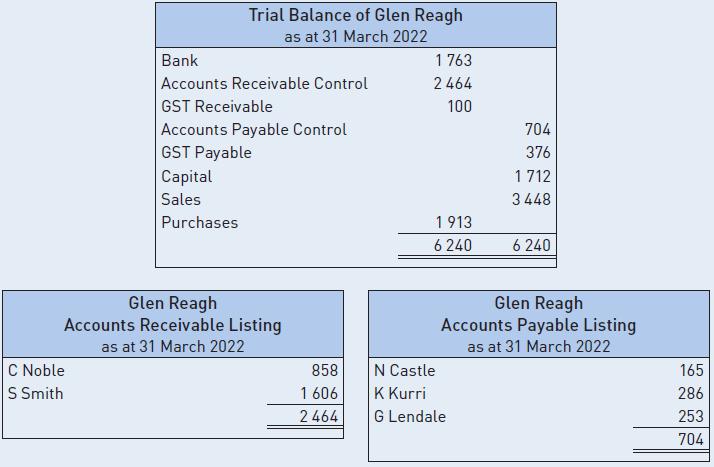

Using the information of Glen Reagh at the end of March 2022 (shown in figure 6.91) and

Question:

Using the information of Glen Reagh at the end of March 2022 (shown in figure 6.91) and the transactions for April:

• enter the appropriate journal abbreviation next to each transaction

• prepare the relevant journals for the month of April 2022

• enter the opening balances in the appropriate ledgers

• post the journals to the general ledger in T account format, and the accounts receivable and accounts payable ledgers in columnar account format

• prepare a trial balance from the general ledger, and

• prepare accounts receivable and payable listings that balance with the respective accounts in the general ledger.

__________ 1 Sold stock to S Smith $2244 ($2040 + $204 GST).

__________ 1 Direct deposit received for March invoices less $22 discount from S Smith.

__________ 1 Purchased stock from G Lendale $198 ($180 + $18 GST).

__________ 1 Transferred funds for $154 to N Castle in full settlement of March account.

__________ 2 Remitted funds to K Kurri to pay March tax invoices $286.

__________ 2 G Lendale’s March account was paid less $22 discount.

__________ 10 N Lambton forwarded $2893 ($2630 + $263 GST) tax invoice for a new photocopier.

__________ 10 Sold goods on credit to F White for $2794 ($2540 + $254 GST).

__________ 15 Glen Reagh sold inventory on credit $1903 ($1730 + $173 GST) to C Noble.

__________ 15 Purchased goods on credit from G Lendale $231 ($210 + $21 GST).

__________ 17 Sold goods following direct deposit from F Williams for $1133 ($1030 + $103 GST).

__________ 19 Tax invoice from N Castle $286 ($260 + $26 GST) for goods.

__________ 20 Bought goods from K Kurri $385 ($350 + $35 GST).

__________ 21 S Smith was sold goods on credit for $2277 ($2070 + $207 GST).

__________ 25 E Cooper purchased goods $1628 ($1480 + $148 GST) and paid by debit card.

__________ 28 Forwarded adjustment credit note to S Smith for damaged goods $33 ($30 + $3 GST).

__________ 29 Paid Charlestown BP $396 ($360 + $36 GST) for this month’s petrol.

__________ 30 Received funds from F White in full settlement of account less $77 discount.

Step by Step Answer:

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson