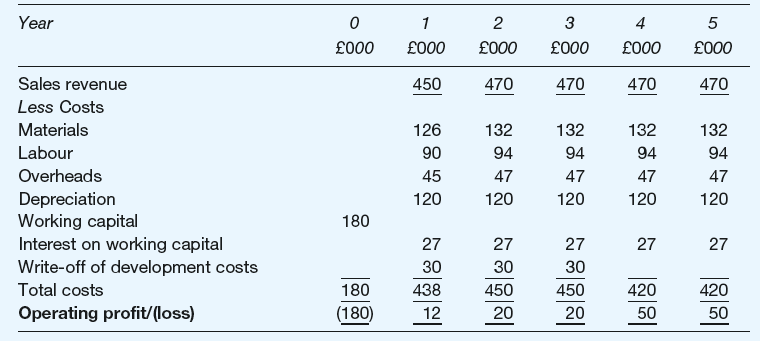

The accountant of your business has recently been taken ill through overwork. In his absence his assistant

Question:

You ascertain the following additional information:

1 The cost of equipment includes £100,000, being the carrying value of an old machine. If it were not used for this project it would be scrapped with a zero net realisable value. New equipment costing £500,000 will be purchased on 31 December Year 0. You should assume that all other cash flows occur at the end of the year to which they relate.

2 The development costs of £90,000 have already been spent.

3 Overheads have been costed at 50 per cent of direct labour, which is the business€™s normal practice. An independent assessment has suggested that incremental overheads are likely to amount to £30,000 a year.

4 The business€™s cost of capital is 12 per cent. Ignore taxation in your answer.

Required:

(a) Prepare a corrected statement of the incremental cash flows arising from the project. Where you have altered the assistant€™s figures you should attach a brief note explaining your alterations.

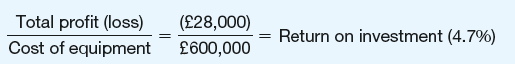

(b) Calculate:

1 The project€™s payback period.

2 The project€™s net present value as at 31 December Year 0.

(c) Write a memo to the board advising on the acceptance or rejection of the project.

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Accounting and Finance An Introduction

ISBN: 978-1292088297

8th edition

Authors: Peter Atrill, Eddie McLaney