On 1 January 2026 Rachelle Zalmstra and Jay Muscat formed a partnership, agreeing to share profits and

Question:

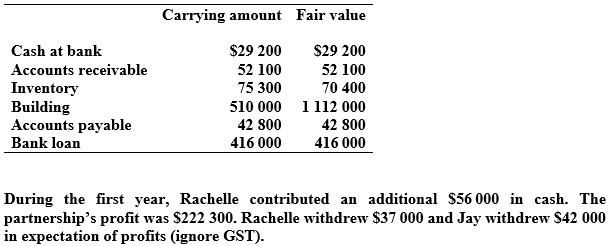

On 1 January 2026 Rachelle Zalmstra and Jay Muscat formed a partnership, agreeing to share profits and losses equally. Rachelle contributed \($185\) 300 in cash, and plant and equipment with a fair value of \($277\) 900. Assets contributed to and liabilities assumed by the partnership from Jay 's business at both carrying amount and fair value are shown below.

Required

(a) Prepare the journal entries to record each partner’s initial investment.

(b) Prepare the partnership’s balance sheet as at 1 January 2026.

(c) Prepare a statement of changes in partners’ equity for the year ended 31 December 2026, using method 1 for recording partners’ equity accounts.

Step by Step Answer:

Accounting

ISBN: 9780730382737

11th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie