When the accountant of Trillo Company prepared the bank reconciliation on May 31, 2014, there were three

Question:

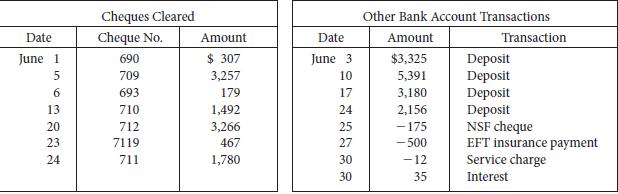

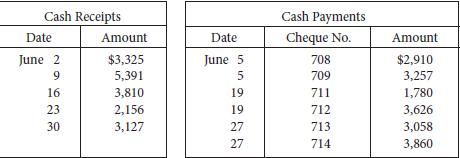

When the accountant of Trillo Company prepared the bank reconciliation on May 31, 2014, there were three outstanding cheques: #690 for $307, #693 for $179, and #694 for $264. There were no deposits in transit as at May 31, 2014. The bank balance at May 31 was $17,690. The balance in the cash account on the May 31, 2014, adjusted trial balance was $16,940. The following is selected information from the June bank statement:

The NSF cheque was originally received from a customer, Massif Co., in payment of its account of $165. The bank included a $10 service charge for a total of $175. Information from the company’s accounting records follows:

Investigation reveals that cheque #712 was issued to purchase equipment and cheque #710 was issued to pay an account payable. All deposits are for collections of accounts receivable. The bank made one error: cheque #7119 for Trill Co. Ltd. was charged to Trillo’s bank account.

Instructions

(a) Calculate the balance per bank statement at June 30 and the unadjusted Cash balance per company records at June 30.

(b) Prepare a bank reconciliation at June 30.

(c) Prepare the necessary adjusting entries at June 30.

(d) What balance would Trillo Company report as cash in the current assets section of its balance sheet on June 30, 2014?

Will the bank be concerned if it looks at Trillo Company’s balance sheet and sees a different number than the one on the bank statement? Why or why not?

Step by Step Answer:

Accounting Principles Part 1

ISBN: 978-1118306789

6th Canadian edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Kinnear, Joan E. Barlow