Insurance companies use a number of factors to help determine the premium amount for car insurance coverage.

Question:

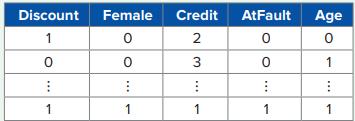

Insurance companies use a number of factors to help determine the premium amount for car insurance coverage. Discounts or a lower premium may be given based on factors including credit scores, history of at-fault accidents, age, and sex. Consider the insurance discount data set from 200 existing drivers. The following variables are included in the data set: Discount (1 if yes, 0 otherwise), Female (1 if female, 0 otherwise), Credit (1 if low, 2 if medium, 3 if high scores), AtFault (1 if history of at-fault accidents, 0 otherwise), and Age (1 if 25 years and older, 0 otherwise). A portion of the data is shown in the accompanying table.

a. Partition the data to develop a naïve Bayes classification model. Report the accuracy, sensitivity, specificity, and precision rates for the validation data set.

b. Display the cumulative lift chart, the decile-wise lift chart, and the ROC curve.

c. Generate the ROC curve. What is the area under the ROC curve (or AUC value)?

d. Interpret the performance measures and evaluate the effectiveness of the naïve Bayes model.

Step by Step Answer:

Business Analytics Communicating With Numbers

ISBN: 9781260785005

1st Edition

Authors: Sanjiv Jaggia, Alison Kelly, Kevin Lertwachara, Leida Chen