Beth and Kate are in partnership. Their financial year ends on 31 December. On 1 January 205

Question:

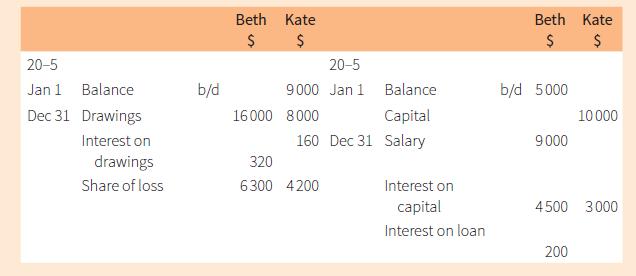

Beth and Kate are in partnership. Their financial year ends on 31 December. On 1 January 20–5 their capitals were: Beth $90,000 and Kate $70,000. The uncompleted current accounts for the year ended 31 December 20–5 were as follows.

a. Explain the entry on 1 January ‘Capital $10,000’.

b. Calculate the profit or loss for the year before appropriations.

c. Calculate the percentage rate of interest on capital the partners received.

d. Calculate the ratio in which the partners shared the loss.

e. State the balance on each partner’s current account on 1 January 20–6, indicating whether each balance is debit or credit.

f. Explain what a credit balance on a partner’s current account means.

g. Explain how a debit balance on a partner’s current account may arise.

h. Suggest one reason why Beth made a loan to the business instead of investing additional capital.

Step by Step Answer:

Cambridge IGCSE And O Level Accounting Coursebook

ISBN: 9781316502778

2nd Edition

Authors: Catherine Coucom