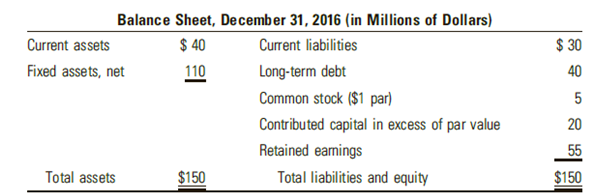

The balance sheet and income statement of Eastland Products, Inc., are as follows: Income Statement for Year

Question:

Income Statement for Year Ended December 31, 2016 (in Millions of Dollars)

Sales......................................................................$120

Cost of sales............................................................80

EBIT.......................................................................$ 40

Interest......................................................................5

EBT......................................................................$ 35

Taxes (40%)...........................................................14

Net Income (EAT)...............................................$ 21

Additional Information

Total Dividends..........................................................$10 Million

Market price of common stock................................$32 a share

Number of common shares issued.........................5 Million

Using these data, determine the following:

a. Earnings per share

b. Price-to-earnings ratio

c. Book value per share

d. Market-to-book ratio

e. EV-EBITDA multiple. Assume the cost of sales includes $10 million in depreciation expenses. Assume there are no amortization expenses.

f. How much of the retained earnings total was added during 2016?

g. Show East land€™s new balance sheet after the company sells 1 million new common shares in early 2017 to net $30 a share. Part of the proceeds, $10 million, is used to reduce current liabilities, and the remainder is temporarily deposited in the company€™s bank account. Later, this remaining amount (along with additional long-term debt financing) will be invested in new manufacturing facilities.

Step by Step Answer:

Contemporary Financial Management

ISBN: 978-1337090582

14th edition

Authors: R. Charles Moyer, James R. McGuigan, Ramesh P. Rao