Consider two companies, A and B. The interest rates at which they can borrow are shown in

Question:

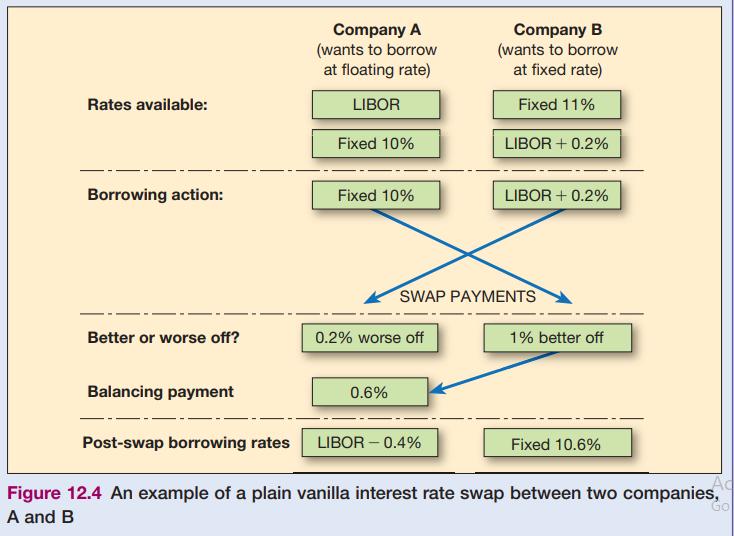

Consider two companies, A and B. The interest rates at which they can borrow are shown in the first part of Figure 12.4. Company A, with a better credit rating, can borrow at a lower fixed and a lower floating rate than Company B. We refer to A as having an absolute advantage over B. However, B has a comparative advantage over A with floating rate borrowing, as its floating rate is proportionately less expensive than its fixed rate when compared with A’s rates. If, for example, LIBOR stands at 5 per cent, then B’s floating rate is 4 per cent more expensive than A’s floating rate (i.e. 0.2 per cent/5 per cent). This compares with B’s fixed rate being 10 per cent more expensive (i.e. 1 per cent/10 per cent) than A’s. Conversely, A has a comparative advantage in fixed rate borrowing.

The prerequisite for a swap agreement to proceed is for both companies to be able to benefit from it. For this to be the case, the companies must want to raise funds by borrowing at the rate in which they do not possess a comparative advantage. In our example, this means that A must want to borrow at a floating rate and B must want to borrow at a fixed rate. If A raises a fixed rate loan at 10 per cent and B raises a floating-rate loan at LIBOR plus 0.2 per cent, and they swap interest payments, then B is 1 per cent better off while A is 0.2 per cent worse off. If B makes a payment of 0.2 per cent to A, then A is neither better nor worse off, whereas B is still 0.8 per cent better off. If the benefits of the swap agreement are to be split evenly between the two parties, then B will have to make a further payment of 0.4 per cent to A. The post-swap borrowing rates are shown in Figure 12.4, where A ends up with a floating rate of LIBOR minus 0.4 per cent and B with a fixed rate of 10.6 per cent.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head