Ms. Pagell is an owner-entrepreneur running a computer services firm worth $1 million. She currently owns 100

Question:

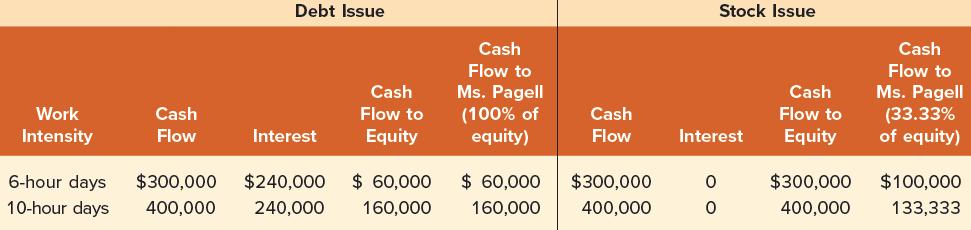

Ms. Pagell is an owner-entrepreneur running a computer services firm worth $1 million. She currently owns 100 percent of the firm. Because of the need to expand, she must raise another $2 million. She can either issue $2 million of debt at 12 percent interest or issue $2 million in stock. The cash flows under the two alternatives are presented here:

Like any entrepreneur, Ms. Pagell can choose the degree of intensity with which she works.

In our example, she can work either a 6- or a 10-hour day. With the debt issue, the extra work brings her $100,000 ( = $160,000 − 60,000 ) more income. However, let’s assume that with a stock issue she retains only a one-third interest in the equity. Here, the extra work brings her merely $33,333 (= $133,333 − 100,000). Being human, she is likely to work harder if she issues debt. In other words, she has more incentive to shirk if she issues equity.

In addition, she is likely to obtain more perquisites (a big office, a company car, more expense account meals) if she issues stock. If she is a one-third stockholder, two-thirds of these costs are paid for by the other stockholders. If she is the sole owner, any additional perquisites reduce her equity stake alone.

Finally, she is more likely to take on capital budgeting projects with negative net present values. For example, she might be tempted to engage in empire building, by overpaying to acquire other firms or overinvesting in internal projects. It might seem surprising that a manager with any equity interest at all would take on negative NPV projects because the stock price would clearly fall here. However, managerial salaries generally rise with firm size, providing managers with an incentive to accept some unprofitable projects after all the profitable ones have been taken on. That is, when an unprofitable project is accepted, the loss in stock value to a manager with only a small equity interest may be less than the increase in salary. In fact, it is our opinion that losses from accepting bad projects are far greater than losses from either shirking or excessive perquisites. Hugely unprofitable projects have bankrupted whole firms, something that even the largest expense account is unlikely to do.

As the firm issues more equity, our entrepreneur will likely increase leisure time, workrelated perquisites, and unprofitable investments. These three items are called agency costs because managers of the firm are agents of the stockholders.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe