Maui Manufacturing, a small manufacturer of electronic parts, has just completed its third year of operations. The

Question:

€¢ Maui€™s equipment consists of several machines with a combined cost of $1,650,000 and no residual value. Each machine has an output of five units of product per hour and a useful life of 15,000 hours.

€¢ Selected actual data of Maui€™s operations for the year just ended is presented here:

Product manufactured..........................................375,000 units

Machine utilization..................................................97,500 hours

Direct labour usage.................................................26,250 hours

Labour rate.............................................................$ 11.25 per hour

Total production overhead..................................$ 847,500

Cost of goods sold...........................................$ 1,290,720

Finished goods inventory (at year end)..............$ 322,680

Work-in-process inventory (at year end).......................$ 0

€¢ Total production overhead is allocated to each unit using an estimated, plant-wide rate.

€¢ The budgeted activity for the year included 20 employees, each working 1,800 productive hours per year to produce 405,000 units of product. The machines are highly automated, and each employee can operate two to four machines simultaneously. Normal activity is for each employee to operate three machines. Machine operators are paid $11.25 per hour.

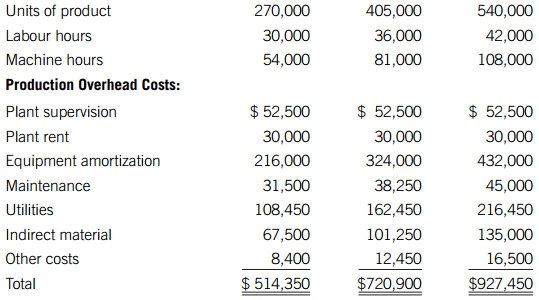

€¢ Budgeted production overhead costs for the past year for various levels of activity are shown here:

Required:

A. Choose the budgeted level of activity (in units) closest to actual activity for the period, and determine the dollar amount of total overapplied/underapplied production overhead. Explain why this amount is material.

B. Leilani Sorter believes that Maui Manufacturing should be using machine hours to allocate production overhead. Using the data given, determine the amount of total overapplied/underapplied production overhead if machine hours had been used as the allocation base.

C. Explain why machine hours might be a more appropriate allocation base than number of units.

D. Explain why using units as denominator volume might cause managers to build up inventories under absorption costing in periods when sales were slumping.

Step by Step Answer:

Cost Management Measuring, Monitoring and Motivating Performance

ISBN: 978-1119185697

3rd Canadian edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook