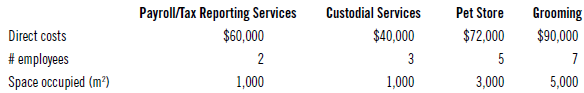

Ridgeway Associates rents space to landscape design business and an environmental consulting business. Ridgeway Associates provides payroll/tax

Question:

REQUIRED

If Ridgeway Associates uses the direct method to allocate costs, what are the monthly rental charges for the landscape design business and the environmental consulting business? (Hint: First, allocate the payroll/tax reporting services costs and the custodial services costs to the landscape design business and the environmental consulting business. Then, add the direct costs and allocated costs together and divide by 12 (months in a year).)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Cost Management Measuring, Monitoring and Motivating Performance

ISBN: 978-1119185697

3rd Canadian edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook

Question Posted: