Investment Advisors, Inc., is a brokerage firm that manages stock portfolios for a number of clients. A

Question:

Investment Advisors, Inc., is a brokerage firm that manages stock portfolios for a number of clients. A particular portfolio consists of U shares of U.S. Oil and H shares of Huber Steel. The annual return for U.S. Oil is $3 per share and the annual return for

Huber Steel is $5 per share. U.S. Oil sells for $25 per share and Huber Steel sells for $50 per share. The portfolio has $80,000 to be invested. The portfolio risk index (0.50 per share of U.S. Oil and 0.25 per share for Huber Steel) has a maximum of 700. In addition, the portfolio is limited to a maximum of 1000 shares of U.S. Oil. The linear programming formulation that will maximize the total annual return of the portfolio is as follows:

Max 3U + 5H Maximize total annual return

s.t.

25U + 50H < 80,000 Funds available

0.50U + 0.25H < 700 Risk maximum

1U < 1000 U.S. Oil maximum

U, H > 0

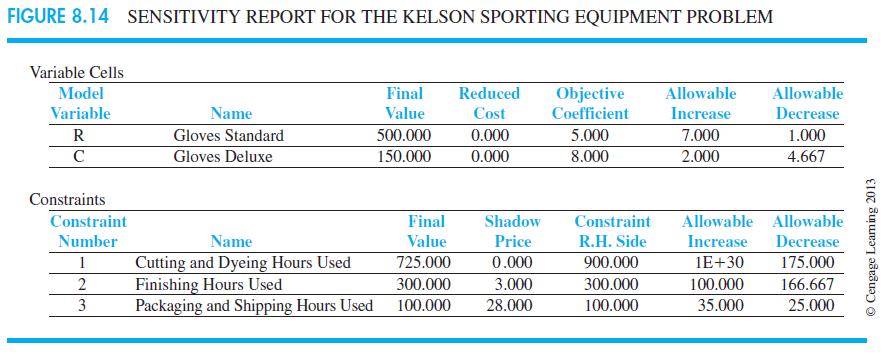

The sensitivity report for this problem is shown in Figure 8.15.

a. What is the optimal solution, and what is the value of the total annual return?

b. Which constraints are binding? What is your interpretation of these constraints in terms of the problem?

c. What are the shadow prices for the constraints? Interpret each.

d. Would it be beneficial to increase the maximum amount invested in U.S. Oil? Why or why not?

Step by Step Answer:

Quantitative Methods for Business

ISBN: 978-0840062345

12th edition

Authors: David Anderson, Dennis Sweeney, Thomas Williams, Jeffrey Cam