Question: Ryan has received cost and salvage value estimates for two competing fire sprinkler systems to be installed in his office building. System A has a

Ryan has received cost and salvage value estimates for two competing fire sprinkler systems to be installed in his office building. System A has a first cost of $100,000, annual M&O costs of $10,000, and a $20,000 salvage value after 5 years. System B has a first cost of $175,000, M&O costs of $8,000, and a $40,000 salvage value after 10 years.

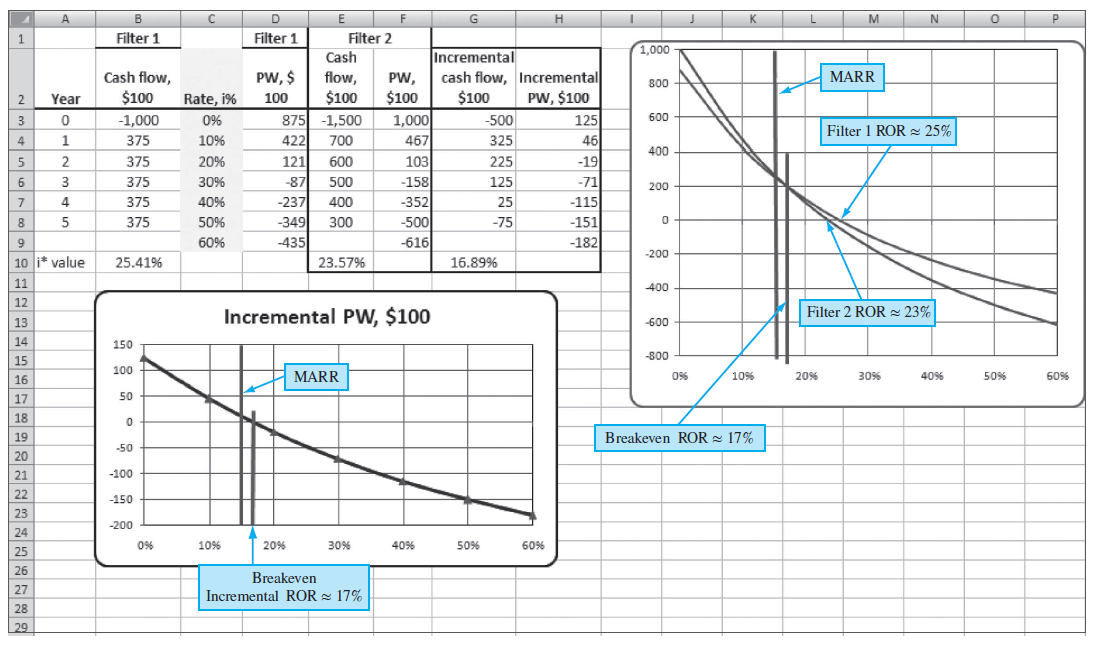

(a) Plot the breakeven ROR point between the two systems using PW values for two situations: incremental cash flows and alternative cash flows. (Use Figure 8–6 as a model.)

(b) State which system is economically preferred if the MARR is larger than this value.

Figure 8-6

Filter 1 Filter 1 Filter 2 1,000 Incremental Cash PW, $ cash flow, Incremental $100 Cash flow, $100 flow, MARR PW, 800 PW, $100 -500 325 Rate, 1% $100 1,000 $100 100 Year 875 -1,500 422 121 -87 -237 -349 -435 125 600 -1,000 0% Filter 1 ROR 2 25% 375 10% 700 467 46 400 103 -158 -19 375 20% 600 225 375 30% 500 125 -71 200 -352 4 375 40% 400 25 -115 -500 375 50% 300 -75 -151 -182 60% -616 -200 10 i* value 25.41% 23.57% 16.89% 11 400 12 Incremental PW, $100 Filter 2 ROR = 23% 13 -600 14 150 -800 15 100 MARR 0% 10% 20% 30% 40% 50% 60% 16 50 17 18 19 Breakeven ROR = 17% -50 20 -100 21 22 -150 23 -200 24 0% 10% 20% 30% 40% 50% 60% 25 26 Breakeven 27 Incremental ROR = 17% 28 29

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

a Graph of breakeven ROR is approximately 85 per year in both renditions b If MARR approximately 8... View full answer

Get step-by-step solutions from verified subject matter experts