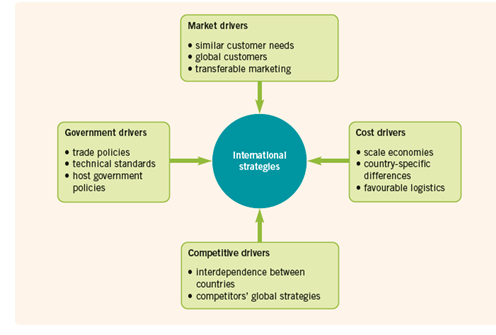

Question: 1. Considering Yips globalisation framework (Figure 9.2), what drivers of internationalisation do you think were most important when Wanda entered the US market through its

2. What national sources of competitive advantage might Wanda draw from its Chinese base? What disadvantages derive from its Chinese base?

3. In the light of the CAGE framework, what challenges may Wanda meet as it enters the US market?

Figure 9.2

Chinese foreign direct investments in the USA have reached record levels and exceeded $10bn (£6bn, ‚¬7.5bn) in 2014. Despite this, Wanda€™s $2.6bn acquisition of US second-largest cinema chain AMC in 2012 and the later $3.5bn acquisition of one of the world€™s biggest movie producers, Legendary Entertainment in 2016, sent shock waves through the US entertainment industry.

The AMC acquisition created the world€™s largest cinema company by revenues and the Legendary Entertainment acquisition was the biggest China€“Hollywood deal ever.

Wanda Cinema Line Corp. is China€™s largest operator by cinema screens with close to 300 cinemas and 2,550 screens. Through the AMC acquisition, Wanda now controls more than ten per cent of the global cinema market.

AMC is the second-biggest cinema chain operator in North America, which is the world€™s biggest film market with ticket sales of over $10bn. The company has more than 5250 screens and 375 theatres in this market and is the world€™s largest operator of IMAX and 3D screens including 120 and 2170 screens, respectively.

The AMC and Legendary investments marked a new era as Chinese investment reached into the heart of US entertainment and culture. Although Chinese acquisitions in the USA have proven to be controversial before, they may prove to be even more challenging, and it was speculated that a Hollywood ending was far from certain.

According to Chen Zheng, manager of Saga Cinema in Beijing, the AMC deal strengthens Wanda€™s global status as movie theatre owner:

€˜Wanda has been the largest theatre owner in the second largest film market in the world. Now the deal makes it also the owner of the second largest theatre chain in the largest film market.€™ 1

Another analyst commented on the Legendary deal:

€˜Buying Legendary entertainment puts Wanda on the road to becoming a global media company and one of the world€™s biggest players in movie production.€™ 2

Legendary Entertainment is a leading film production company that owns film, television, digital and comics divisions. Its big-budget, action and special-effects global blockbuster type of movie productions has performed very well in China. These include films such as The Dark

Knight batman trilogy, Jurassic World , Inception , Pacific Rim and Godzilla €“ the last two particularly successful in China. The Hollywood studio adds experience and expertise to Wanda€™s movie production business. Wanda group is constructing a $8.2bn studio in eastern China which is claimed to be the biggest studio complex globally, competing with and even exceeding Hollywood€™s best studios, but with Chinese costs.

Although the acquisitions are huge, they are relatively small compared with the rest of the Dalian Wanda real-estate conglomerate. Dalian Wanda Group Corp. Ltd includes assets of over $86bn and annual income of about $39bn (2014). Wanda, which means €˜a thousand roads lead here€™, consists of five-star hotels, tourist resorts, theme parks and shopping malls. The €˜Wanda Plaza€™ complexes that combine malls with housing and hotels have been a huge success in China and can be found in more than 60 Chinese cities.

Market drivers similar customer needs global customers transferable marketing Cost drivers Government drivers trade policies technical standards host government policies scale economies country-specific Intemational strategles differences favourable logistics Competitive drivers interdependence between countries competitors' global strategies Gerry Lopez, CEO of AMC Entertainment Holdings, left, shakes hands with Zhang Lin, Vice President of Wanda during a signing ceremorny in Beijing, China, Monday, 21 May 2012.

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

1 All internationalisation drivers play some role in the case First market drivers are important as the Chinese increasingly watch foreign movies and thus share similar customer needs and tastes with ... View full answer

Get step-by-step solutions from verified subject matter experts