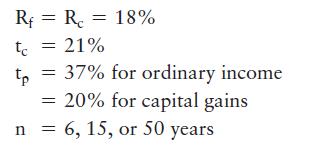

Consider the following facts: Other information: The corporation is formed with a $10,000 contribution. The

Question:

Consider the following facts:

Other information:

• The corporation is formed with a $10,000 contribution.

• The corporation pays no dividends.

• The entities reinvest their after-tax earnings.

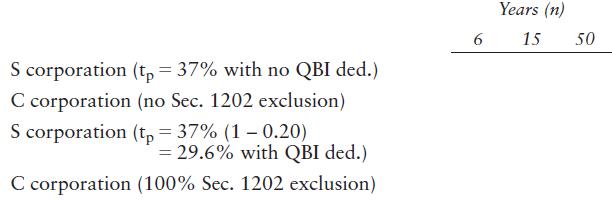

Using the format below, compare after-tax accumulations for each investment horizon.

Should the corporation make the S election for any of these investment horizons?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2023 Individuals

ISBN: 9780137700127

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Question Posted: