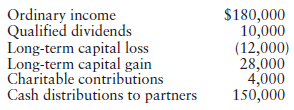

Howard Gartman is a 40% partner in the Horton & Gartman Partnership. During 2016, the partnership reported

Question:

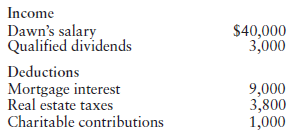

Howard and his wife Dawn, who file a joint return, also had the following income and deductions from sources not connected with the partnership:

Howard and Dawn have two dependent children. During 2016, Dawn had $4,500 in federal income taxes withheld from her salary and Howard made four estimated tax payments of $2,500 each ($10,000 total). Compute Howard and Dawn€™s Federal income tax liability for 2016 and whether they have a balance due or a tax refund. Ignore the child tax credits and the election to take state sales tax as an itemized deduction.

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: