The bank reconciliation made by Johnson Ltd on 31 August 2016 showed a deposit in transit of

Question:

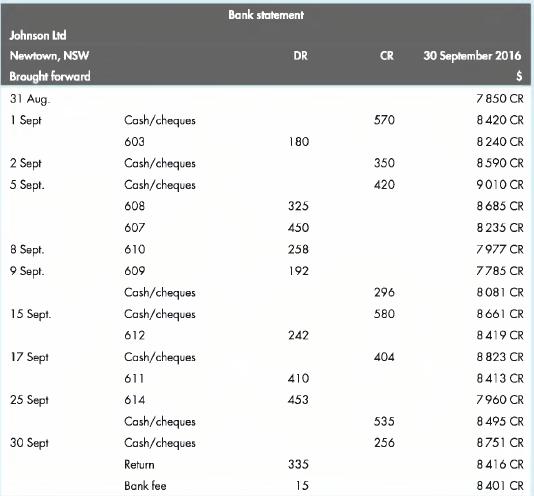

The bank reconciliation made by Johnson Ltd on 31 August 2016 showed a deposit in transit of $570 and two outstanding cheques: no. 597 for $260 and no. 603 for $180. The adjusted balance per books on 31 August was $7980 debit.

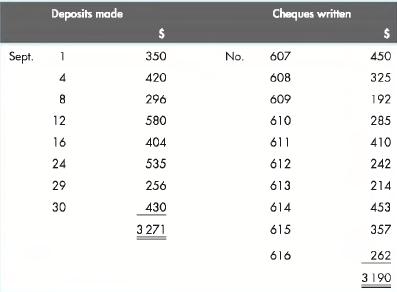

The bank statement shown below is available for September. A list of deposits made and cheques written during September is shown here:

The cash at bank account balance on 30 September was $8061. In reviewing the cheques, the bookkeeper discovered that cheque no. 610, written for $258 for a repairs expense, was recorded in the cash payments journal as $285. The 'return' item for $335, which Johnson deposited on 24 September, was a payment on account from customer D. Lewis (dishonoured cheque).

1. Prepare a bank reconciliation statement for Johnson Ltd at 30 September.

2. Prepare the necessary general journal entries to bring the cash at bank account up-to-date as at 30 September 2016.

3. Could a business dispense with its own cash records and rely entirely on bank statements?

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson