Alpha paid 750,000 to acquire 60% of equity in Beta on 1 January 2010. Betas Statement of

Question:

Alpha paid £750,000 to acquire 60% of equity in Beta on 1 January 2010. Beta’s Statement of financial position as at 31 December 2012 reports its Share capital as £500,000, Share premium as £50,000, and Retained earnings as £320,000. Identify the non-controlling interest to be included in the Consolidated Statement of financial position as at 31 December 2012 in each of the following independent situations: Beta’s shares have a par value of £1 each.

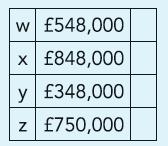

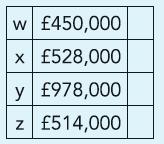

(a) On 1 January 2010 Beta’s retained earnings were £200,000 and the fair value of Beta’s identifiable non-monetary assets were equal to the book value. The value of non-controlling interest on the date of acquisition is to be identified on the basis of the price paid by Alpha to acquire control

(b) On 1 January 2010 Beta’s retained earnings were £160,000, the fair value of its non-current assets exceeded their book value by £100,000 and Beta’s shares were quoted at 225p each

(c) On 1 January 2010 Beta’s retained earnings were £180,000, the fair value of its non-current assets was £90,000 more than the book value and Beta’s shares were quoted at 240p each. As at 31 December 2012 £10,000 of profits reported by Beta is unrealised because they related to sales made to Alpha

(d) On 1 January 2010 Beta reported an accumulated loss of £120,000, though the fair value of its non-current assets exceeded their book value on that date by £50,000 and Beta’s shares were quoted at 255p each

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict