As at 31 December 2012 the retained earnings reported in their own Statement of income by Alpha

Question:

As at 31 December 2012 the retained earnings reported in their own Statement of income by Alpha was £394,500 and by Beta £240,000. Identify the Consolidated Retained earnings as at 31 December 2012 on each of the following independent scenarios.

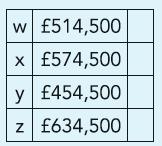

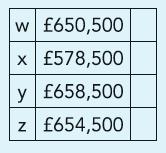

(a) Alpha acquired 75% of Beta’s equity on 1 January 2008 when Beta’s retained earnings were £80,000

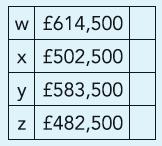

(b) Alpha acquired 90% of Beta’s equity on 1 January 2010 when Beta’s retained earnings were £120,000; and during the year ended 31 December 2012, an unrealised profit of £20,000 had to be eliminated from Alpha’s retained earnings. Ignore fair valuation adjustments

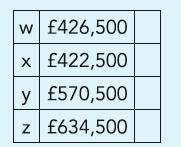

(c) Alpha acquired 80% of Beta’s equity on 1 January 2010 when Beta’s retained earnings were £180,000. During the year ended 31 December 2012 an unrealised profit of £20,000 had to be eliminated from Beta’s retained earnings

(d) Alpha acquired 60% of Beta’s equity on 1 January 2010 when Beta’s retained earnings were £140,000. During the year ended 31 December 2012 an unrealised profit of £20,000 had to be eliminated from Beta’s retained earnings and £10,000 written off as impairment of goodwill

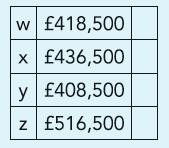

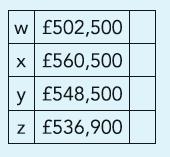

(e) Alpha acquired 80% of Beta’s equity on 1 January 2011 when Beta reported a retained loss of £90,000. Fair valuation recognised at acquisition was £120,000 and, as a result, an additional depreciation needs to be written off at £5,000 per annum

(f) Alpha acquired 80% of Beta’s equity on 1 January 2011 when Beta’s retained earnings were £90,000. Fair valuation gain was £100,000 and as a result the additional depreciation that needs to be written off is £15,000. Negative goodwill on acquisition of Beta was £58,000

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict